The 2023 federal budget included a variety of measures to channel public dollars in clean growth projects to encourage private capital to follow. In total, the budget outlined $70 billion to support major investments in clean electricity and clean growth.

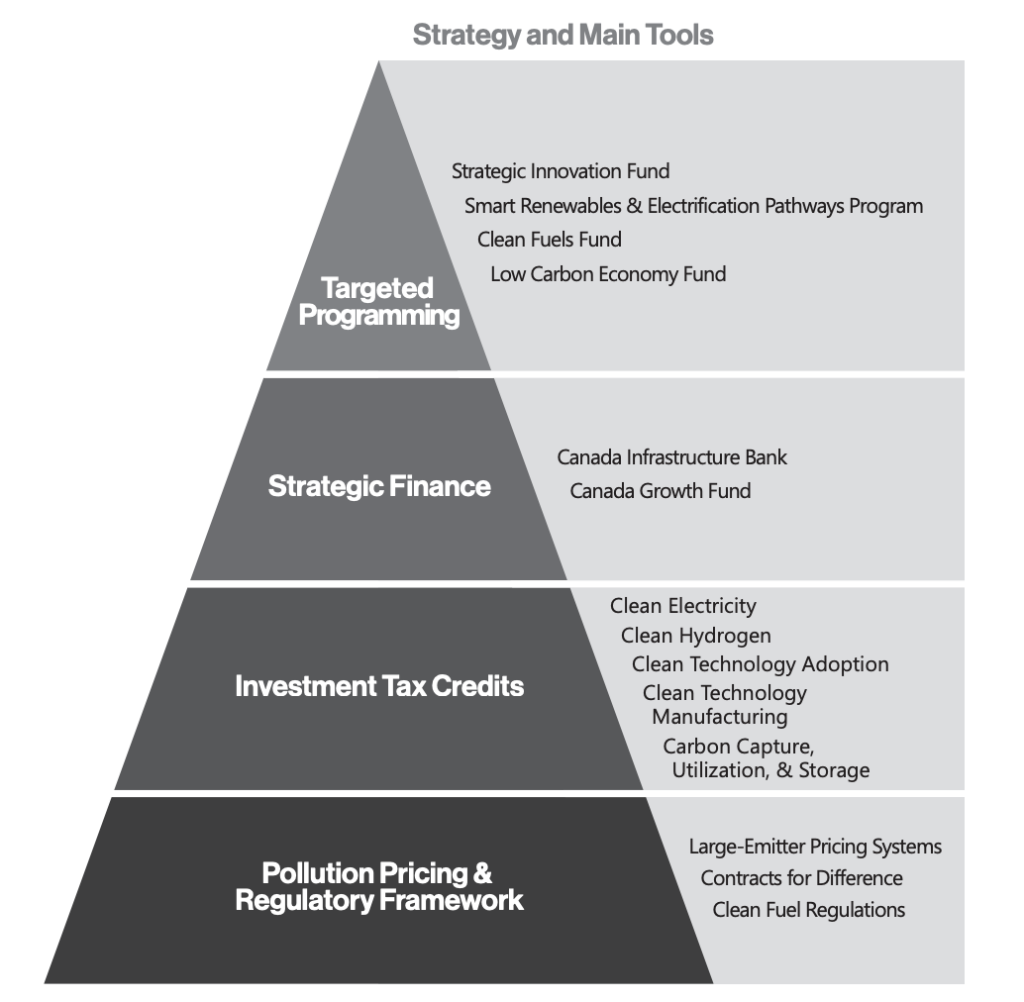

While reading through the list of measures may make it hard to see how they work together, one diagram in Budget 2023 sums up the “made-in-Canada” strategy nicely (see Figure 1).

Figure 1: Budget 2023’s policy pyramid for mobilizing private capital for clean growth

Let’s look at what this policy pyramid means for Canada’s clean economy—and why we think it is so important.

Carbon pricing remains the strong foundation for Canada’s clean growth

At the bottom of the pyramid is economy-wide pollution pricing and smart, flexible regulatory frameworks—the foundation for all other policies to complement and build on. Budget 2023 confirms the government’s commitment to carbon contracts for difference. These contracts act as an insurance policy for investors, guaranteeing future carbon prices and insulating investors from potential future policy changes. This will bring the stability necessary for private-sector investment in the clean economy. The bottom layer of the pyramid also includes the flexible, market-based clean fuel regulations, which likewise create broad incentives.

Taken together, Canada’s foundation is what sets it apart from the U.S. and its Inflation Reduction Act. Canada’s approach uses policy ‘sticks’ to do the heavy lifting, discouraging heavy polluters instead of relying solely on economy-wide subsidies, or ‘carrots’. This is not only less expensive than handing out subsidies broadly, but it also allows Canada to be more shrewd with how it uses its carrots.

Investment Tax Credits incentivize clean technology manufacturing and adoption

On top of carbon pricing, Budget 2023 introduces substantial new investment tax credits and additional information on programs that were announced previously. Amidst all these new incentives, the breadth of eligible technologies and activities is what stands out. It covers clean electricity (including generation, storage, and transmission), clean hydrogen, clean technology adoption, clean technology manufacturing (including the extraction, processing and recycling of key critical minerals), and carbon capture, utilization, and storage. While this breadth may be interpreted as a lack of focus, it could also be seen as an attempt from the government to set a broad incentive structure and let market forces fill in the details—rather than “picking winners.”

Two other aspects are noteworthy about the investment tax credits for clean growth. First, there is a strong focus on clean electricity—this is a crucial ingredient to Canada’s competitiveness in a low-carbon future. Affordable, abundant access to clean power is what makes Canada an attractive destination for global investors. Second, Budget 2023 does replicate the U.S. Inflation Reduction Act in a positive way, namely by linking the level of available tax credits to companies meeting certain labour conditions that include fair pay, benefits for workers, and employment of apprentices.

Interactions between the investment tax credits and carbon pricing create risks worth considering carefully. Emissions reductions achieved from the projects made possible by the investment tax credits could flood provincial credit markets under the output based pricing systems and cause prices to crash, undermining the effectiveness of carbon pricing. This is a serious concern that requires real attention in the carbon pricing review in 2027, by which time some of these projects may be in operation. One possible remedy may be to make emissions reductions achieved by projects that benefited from the Investment Tax Credits ineligible for generating carbon credits. We’ll take a closer look at these interactions in the future.

Risk-sharing mechanisms will accelerate strategically important projects

On top of Investment Tax Credits, Budget 2023 pitches the Canada Infrastructure Bank and the Canada Growth Fund as vehicles for targeted public investment in strategically important clean growth projects. Both of these institutions have been established to work similar to ‘green banks’ that spur private investment by offering access to capital at more favourable terms than commercial banks. This approach focuses on sharing risks with private investors rather than handing out direct subsidies, making it more cost-effective and less risky for the Canadian public.

Budget 2023 also delivered more detail on governance of the newly established Canada Growth Fund. The Public Sector Pension (PSP) Investment Board, a Crown corporation, will manage the Fund’s assets. This institutional set-up promises a healthy balance between political independence of investment decisions and financial expertise while maintaining strong accountability for the Fund’s performance in accordance with its mandate. But important details still need to be hammered out. For example, what are the relevant accountability mechanisms? And how will the Fund define its investment criteria? The mandate of the Growth Fund will be to deliver returns to society not just investors; that will be a change of perspective for the investors at PSP.

In addition, the budget announced that the Canada Infrastructure Bank will provide loans to Indigenous communities to support them in purchasing equity stakes in infrastructure projects the Bank is investing in. Enabling Indigenous ownership in clean growth projects is a crucial element of economic reconciliation.

Targeted programming tops off Canada’s policy pyramid

At the top of the pyramid, Budget 2023 replenishes existing government programs that focus on targeted aspects of Canada’s low-carbon transition, including the Strategic Innovation Fund and the Smart Renewables & Electrification Pathways Program. These funds aim to catalyze growth in sectors where Canada has existing competitive advantages like renewable electricity and clean fuels.

A strong base makes a pyramid stable

To sum it up, the ‘policy pyramid’ for mobilizing private capital for clean growth strikes a productive balance between strengthening Canada’s economy-wide carbon price through carbon contracts for difference, while introducing new, more targeted policies that support strategically important sectors. The federal government had to strike multiple balances in this budget: between focusing support on the most promising technologies and activities and ‘picking winners’, and between spending enough public money to drive change and preventing subsidization of projects that would go ahead without or with less government support.

Looking ahead, Budget 2023 also identifies the next challenge for Canada’s clean growth future: getting shovels in the ground. This includes building the infrastructure and supply chains needed to facilitate the economy’s transformation. It will also mean speeding up regulatory approval processes and permitting without compromising progress on Indigenous rights and reconciliation and environmental sustainability.

More work lies ahead to secure Canada’s competitiveness in a low-carbon world, but in this week’s Budget, the federal government has created a solid foundation.