This is the third article in a series of three on Canada’s climate objectives and the oil and gas sector, originally published in Policy Options.

Companies responsible for 95 per cent of oilsands production in Canada have committed to achieving net-zero upstream emissions by mid-century.

Achieving this ambitious goal requires timely and unprecedented investments. It will also be essential to comply with the federal government’s forthcoming cap on oil and gas emissions and to stay competitive in the global low-carbon transition.

Looking across the options that oilsands producers have to reduce their emissions, carbon capture and storage (CCS) could have the biggest impact. Despite its potential, however, the economic case for CCS is still unclear. Publicly available information is limited and shows a wide range of costs to deploy the technology.

Meanwhile, the largest oilsands operators are requesting an additional $11 billion from governments to help pay for CCS projects.

To shed light on how existing regulations and proposed financial incentives affect the economics of oilsands CCS projects, we developed a cash-flow model (using publicly available information) to examine the viability of retrofitting two hypothetical oilsands facilities with CCS.

(For the purposes of our analysis, we leave aside questions about whether CCS technology can be deployed at scale and assume it can and should be scaled.)

The upshot? Our modelling shows that these projects are economically viable after factoring in Canada’s suite of climate regulations and incentives, including the rising carbon price. In fact, our modelling shows private investment in oilsands CCS projects could yield substantial returns for the companies.

These findings raise big questions about the role of government policy, particularly at a time when the oilsands industry is asking for billions of dollars in additional taxpayer funds.

For starters, our results show why further public subsidies, beyond what have been announced, are not necessary to make these projects economic.

They also highlight the need to design public incentives with mechanisms that prevent excessive profits from supporting projects that would ultimately make it harder and more expensive to reduce emissions.

In addition, the results show why it’s critical to finalize keystone policies to get oilsands CCS projects off the ground and to provide policy certainty. Not all CCS projects will get the same incentives, project costs vary and critical incentives from federal and provincial carbon pricing systems are not easy to bank on in the long term.

Proposed contracts for differences that would help underwrite the carbon-pricing risk, as well as proposed investment tax credits, have been slow to be developed and are not yet final.

As federal and provincial governments continue to weigh the economics and tradeoffs at play, we offer three major takeaways from our results (our in-depth technical supplement is forthcoming on the Pembina Institute website).

1. Deploying CCS on oilsands facilities can improve the industry’s carbon competitiveness but does not eliminate transition risk

Scaling up CCS could significantly cut emissions and improve an oilsands facility’s carbon competitiveness.

A new analysis by the Canada Energy Regulator (CER) shows that as the transition to a global low-carbon economy accelerates, oil demand is expected to decline significantly. In that shrinking market, oil producers with the lowest costs and carbon intensities will be more competitive and will have a lower risk of their facilities becoming stranded.

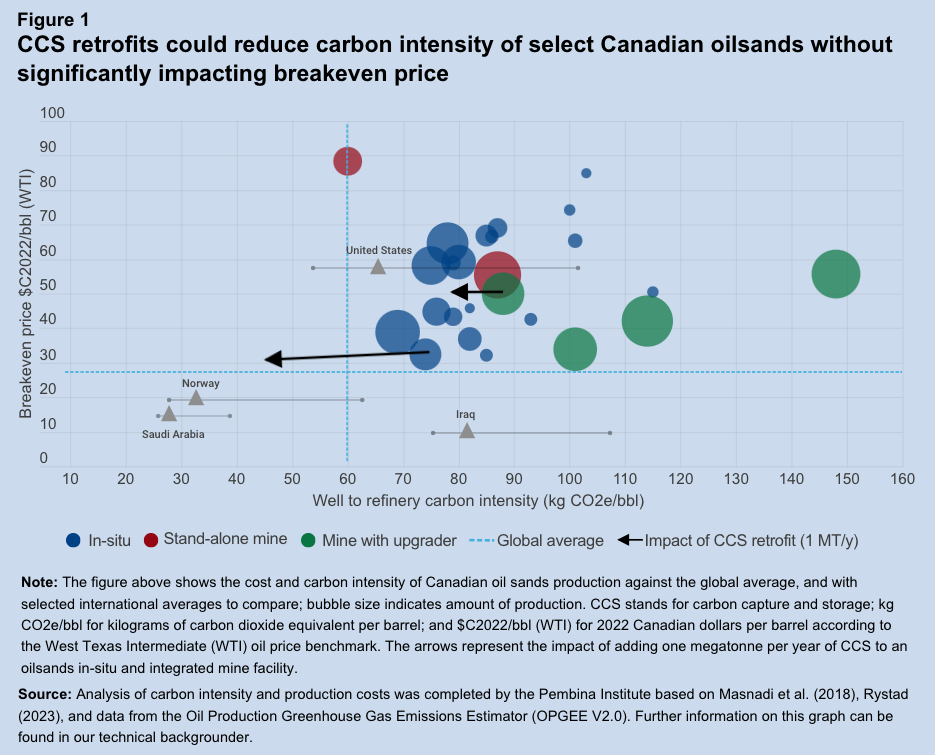

The chart below shows carbon intensity and production costs for existing Canadian oilsands facilities and how they compare with international crudes.

Some Canadian facilities perform only a little worse than global averages, while some are much worse. Over time, as oil demand declines, cost pressures and the requirements to reduce emissions could increase stranded-asset risk for facilities with higher break-even prices and higher carbon intensities.

The figure above shows the impact of adding one megatonne per year of CCS to an oilsands in-situ and to an integrated mine facility.

At the in-situ facility, CCS could allow it to beat the global average crude oil emissions intensity, cutting emissions by 40 per cent. An oilsands mining facility, on the other hand, would need to invest in several CCS projects to achieve global average emissions intensity.

Importantly, both projects could generate net earnings from installing CCS, equivalent to about $2 per barrel, improving a project’s cost competitiveness.

These improvements would not, however, eliminate the transition risk facing oilsands facilities. Achieving the Paris Agreement goal requires a steep drop in the emissions generated from upstream oil production over time (about 90 per cent from 2023 levels, according to the CER analysis), so benchmarking against current averages will not be good enough.

Moreover, installing CCS might not be worth it at facilities with limited remaining reserves, or very high carbon and cost intensities, because it may not be feasible or justifiable to make them competitive in the medium to longer term.

Even for competitive projects, stranded asset risk is not static. Those with longer economic lifespans and lower risk today will eventually face a high longer-term risk of becoming stranded as global oil demand declines.

2. Governments should follow through with announced policy measures swiftly, so installing CCS on existing oilsands facilities is economically viable before 2030

A key indicator for whether any decarbonization project is economically viable is how its cost compares to Canada’s rising federally set carbon price, which applies to large industrial emitters. If the cost to reduce (or eliminate) emissions from a facility is cheaper than paying a carbon price on these same emissions, businesses have an incentive to build the decarbonization project.

Our modelling shows that both types of CCS projects are economically viable against this measure.

We estimate that installing CCS at an in-situ facility (capturing and sequestering emissions from natural gas-fired steam and power) and an oilsands mining facility (capturing and sequestering emissions from the upgrader hydrogen plant), will cost between $89 to $144 per tonne of emissions avoided. This cost is below the carbon price which is set to rise to $170 per tonne in 2030.

Our results also emphasize the importance of policy certainty from governments, especially the commitment to implement “carbon contracts for differences.”

For example, these contracts could allow project developers to bank on Alberta’s technology innovation and emissions reduction (TIER) system credits reaching a certain agreed price. Since large decarbonization projects depend on revenue from carbon credits, this increased certainty is important for investment decisions.

Our analysis also underscores the importance of the proposed federal carbon capture, utilization and storage (CCUS) investment tax credit to the viability of CCS projects, along with credit prices under the federal government’s clean fuel regulation credits.

3. No new public supports are required to get oilsands CCS off the ground

The results from our cash flow model show that government policies are critical to making oilsands CCS economically viable. Government funding in the form of a limited CCUS investment tax credit can help reduce the risk for these big, capital-intensive projects and kickstart decarbonization in the oilsands – as well as in other sectors such as cement.

But our analysis also provides important insights into the broader debate about fossil fuel subsidies on the path to net-zero.

The biggest incentives for oilsands CCS come from carbon pricing, especially TIER credits but also from clean fuel regulations credits. These incentives do not come from taxpayers; industrial polluters buy them to meet their emission reduction requirements.

By contrast, the federal government’s proposed tax credits for CCS projects are a more conventional type of public subsidy but play a smaller role in the economic viability of CCS.

At a minimum, our results suggest that by 2030 – assuming proposed federal policies are finalized soon – additional public support for oilsands CCS will not be required to make these projects economically viable. In fact, any additional public support beyond the proposed incentives risks providing excessive profits for oilsands CCS deployment.

Our analysis shows that oilsands CCS projects could generate returns that are highly competitive with other investments in the sector.

Using middle estimates for capture costs, transport costs, incentive levels and project lifespan, our analysis suggests that installing CCS could generate returns as high as 21 per cent at a mining facility and 12 per cent at an in-situ facility. Even in a scenario where a project becomes stranded in 10 years, these projects could generate average returns above eight per cent.

Many CCS projects need the proposed incentives, but the potential for high private returns suggests that existing and proposed policies and supports should be designed carefully to reduce excessive profits.

Under an oil and gas emissions cap, investments in CCS will become a cost of compliance – or a cost of doing business – so any private return above zero should raise questions about whether public supports are appropriate and necessary in the sector.

In practice, this could mean designing carbon contracts for differences and CCUS tax credits in ways that reduce potential liabilities on taxpayers and excessive profits for companies.

It could also mean focusing government policies on oilsands projects that can demonstrate lower production costs and lower carbon emissions, betting on projects that will have a greater chance of surviving declining global demand. In the energy regulator’s recent analysis, only the most efficient projects continue to produce in a world with dramatically lower oil demand.

Still, these findings point to a much bigger need for a comprehensive and transparent framework that governments can use for determining whether – and under what conditions – they should support the decarbonization of upstream oil and gas. We looked at this broader question in the second instalment in this series.

Walking a fine line on CCS policy for the oilsands

The global low-carbon transition is ushering in a new investment and policy environment for Canada’s oil sector. Widespread and rapid deployment of CCS will likely be an essential ingredient for oilsands to stay competitive and in business.

Our analysis suggests that investments in oilsands CCS could offer compelling private shareholder returns if governments can finalize proposed incentives and policies.

In fact, in the context of the federal government’s forthcoming cap on oil and gas emissions, investments in CCS could offer that sector above-market returns for what will arguably become a cost of doing business and a form of regulatory compliance.

Governments therefore must walk a fine line on oilsands CCS incentives moving forward. Finalizing keystone policies is critical. At the same time, it is incumbent on governments to design these policies in ways that guard against excessive private profits from public incentives and that minimize the risk of making bad bets.

Details of the methodology and assumptions used in this analysis are forthcoming and will be available on the Pembina Institute website.