BACKGROUNDER

December 2024

About carbon pricing in Canada

Under federal law, every province and territory can choose to develop their own carbon pricing system, or to have a federal system, known as the backstop. Binding these systems together is a set of minimum national standards for carbon pricing, known as the federal benchmark.

In addition, every province and territory effectively has two carbon pricing systems: a consumer carbon price (often referred to as the “carbon tax”) on fuels used by individuals and small businesses, and an industrial carbon price for large emitters like steel or cement producers.

To protect the competitiveness of trade-exposed industries, industrial carbon pricing systems require large facilities to pay a fraction of the carbon price on their total emissions. Because these systems create markets for facilities to buy and sell permits for their emissions, we call them large-emitter trading systems, or LETS.

How large-emitter trading systems work

The purpose of LETS is to incentivize emissions reductions at a low financial cost to minimize the risk that facilities will move production to countries where rules on emissions are weaker (known as carbon leakage).

There are two main categories of LETS: intensity-based systems and cap-and-trade.

In intensity-based systems, facilities are subject to emissions intensity performance standards. If a facility outperforms the standard—meaning its operations are less emissions-intensive—it is granted performance credits that it can sell to other facilities or bank for future use. If a facility underperforms the standard, it must compensate for its excess emissions, either by buying credits from other facilities, purchasing offset credits (where permitted), or paying a fixed carbon price. Over time, the carbon price rises and performance standards become stricter (or “tightens”), incentivizing continued emissions reductions.

In cap-and-trade systems, facilities must obtain permits for their emissions. They are granted some of these permits at no cost (known as free allowances), and they must obtain the rest at auction. The carbon price varies by auction, and is subject to both a price floor and a price ceiling, which means credit prices are not allowed to be sold below or above those levels. Facilities can then trade the auctioned permits. The system-wide cap and the quantity of free allowances declines over time, leading to a higher auction price and lower emissions.

There are many differences between LETS

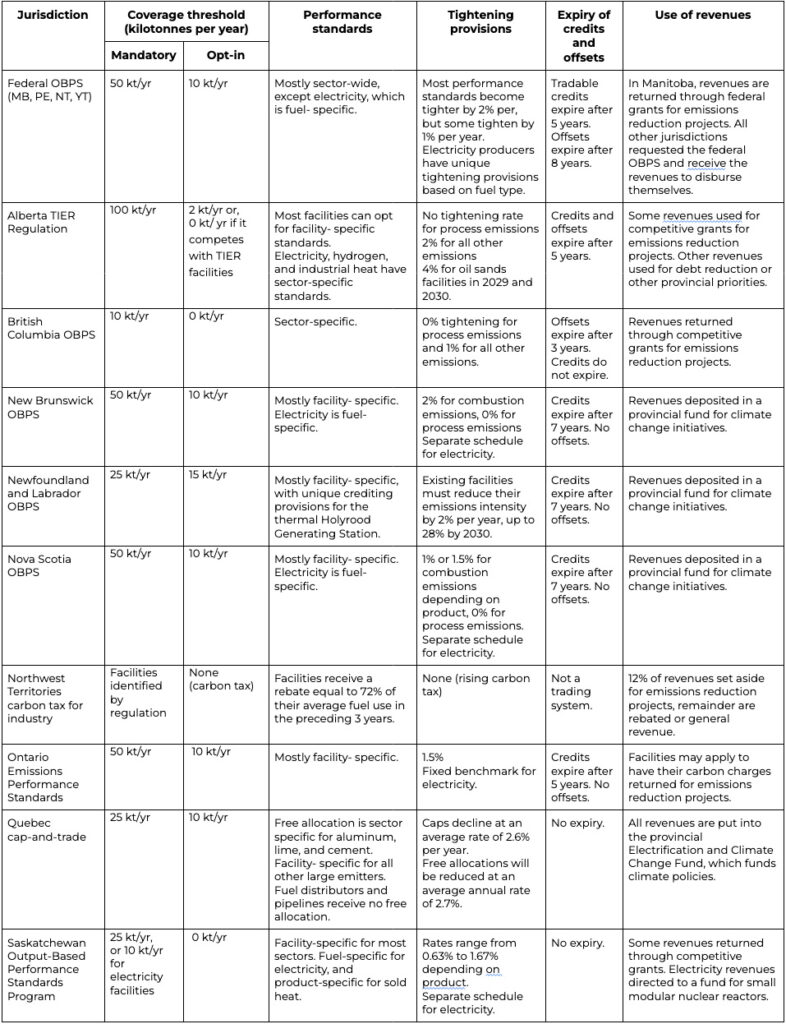

There are nine LETS in Canada (Figure 2), and they differ in various ways. For example, the emissions thresholds that decide participation are different across the country. Some systems allow the use of offsets and some do not.

Most critically, the performance standards in intensity-based systems vary widely. Some require a whole sector to compete against the same standard, while others require facilities to compete against their own historical emissions intensity. The latter approach is better for containing costs, but weakens the reward for best-in-class performance. The performance standards across the country also tighten at different rates.

Comparing regional systems and features

The federal output-based pricing system (OBPS) applies in Manitoba, Prince Edward Island, Nunavut, and Yukon. It is an intensity-based system that is designed to be applied anywhere in Canada, so it features fewer facility-specific performance standards than many other systems. The revenues from this system are returned to the jurisdiction of origin either by direct transfer or through federal programming.

Alberta’s Technology Innovation and Emissions Reduction (TIER) Regulation is also an intensity-based system and is the largest single LETS in Canada, since Alberta accounts for around 60 per cent of the country’s industrial emissions. Most of the performance standards in TIER are facility-specific, and it has unique mechanisms to further control costs.

Most provinces also have intensity-based LETS. The British Columbia OBPS is notable for relying mainly on sector-wide performance standards, unlike most other systems. The Nova Scotia OBPS and New Brunswick OBPS are similar in many respects, though New Brunswick’s system has some unique provisions for facilities that use biomass for fuel. For more details on these intensity-based systems, including Ontario’s Emissions Performance Standards and Saskatchewan’s OBPS Program, see Table 1.

Quebec’s cap-and-trade system is the only system of its type in Canada. Quebec’s market is integrated with the Western Climate Initiative, which currently includes California (the state of Washington might join in future). This gives large emitters in Quebec access to a trading market even larger than Alberta’s. The liquidity of this market, and the availability of low-cost offsets, have resulted in a lower carbon price in Quebec than elsewhere in Canada.

The Northwest Territories carbon tax for industry is also unique, because it is a fuel levy for industry rather than a trading system. This system reduces costs to large emitters by issuing a rebate that covers a large share of their carbon tax liabilities.

Table 1, below, presents a more detailed summary of the LETS across Canada.

Table 1: Comparison of large-emitter trading systems in Canada