Industrial carbon pricing systems are Canada’s most important policy lever for cutting carbon pollution and creating a competitive clean economy with low costs for businesses and big incentives for investment in low-carbon projects. These systems are also designed to cost next to nothing for Canadian consumers.

The Canadian Climate Institute has done extensive research and modelling quantifying the effects of this policy. This fact sheet outlines how and why industrial carbon pricing has virtually no impact on the day-to-day expenses of average Canadians:

- Industrial carbon pricing costs Canadian consumers next to nothing—and in some cases even provides benefits.

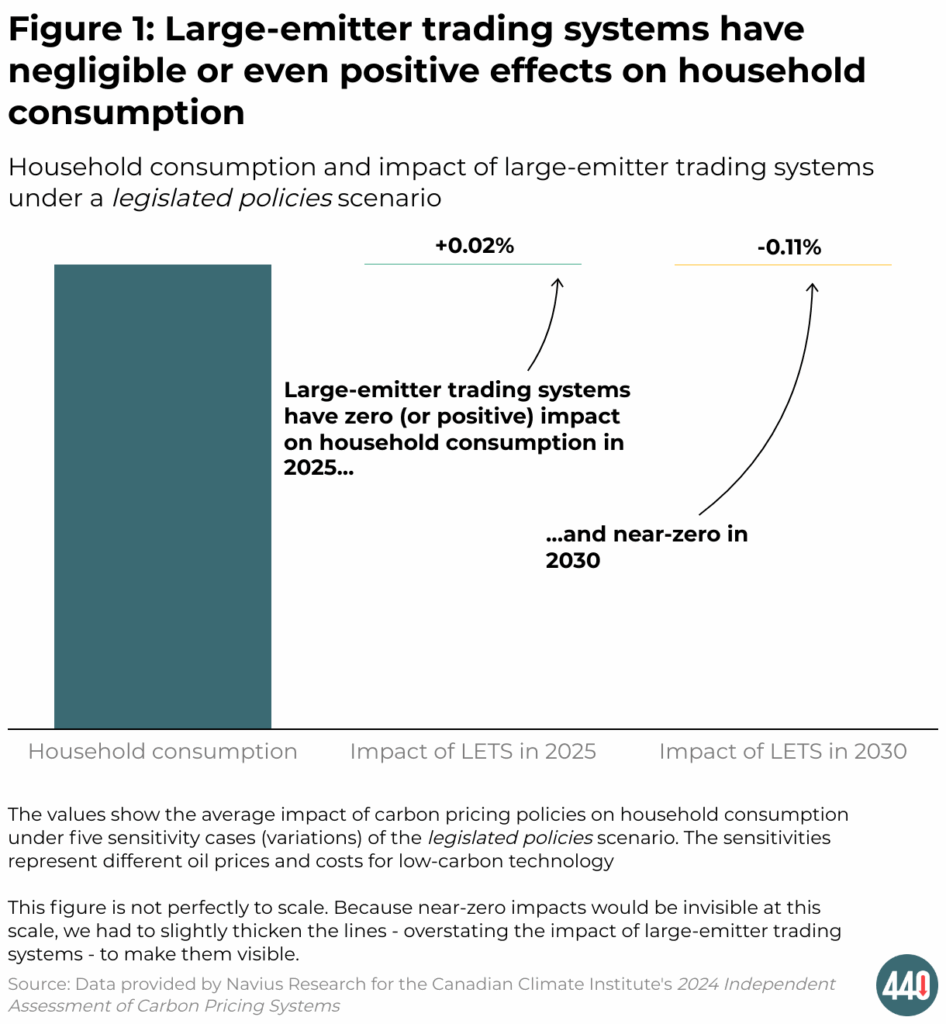

- Our research shows that industrial carbon pricing systems have an impact of around zero per cent on household consumption, a measure of income, in 2025. These costs are projected to remain very low and reduce consumption by just a tenth of one per cent by 2030.

- In some cases, industrial carbon pricing—also called large-emitter trading systems—provides small net benefits for consumers, largely because of provisions in Alberta’s system that can reduce the cost of electricity.

- Industrial carbon pricing applies to goods sold on international markets where most price increases aren’t passed on to consumers.

- Most companies that participate in industrial carbon pricing systems sell a significant portion of their products in other countries.

- About 50 per cent of the output of Canada’s large emitters is exported, and some industries export much more, which lowers costs on consumers. For example, the oil sands send closer to 80 per cent of production abroad.

- In addition, these exported products are sold on global commodity markets, which set the price paid and further limits the amount passed on to consumers.

- Industrial carbon pricing has essentially no impact on the price of food and the agricultural sector.

- Our modelling, done in partnership with Navius Research for the Independent Assessment of Carbon Pricing Systems shows that industrial carbon pricing has near zero overall impact on households’ spending on food.

- The same analysis projects that the cumulative GDP impact on the agricultural sector would be 0.08 per cent by 2030.

- Farmers don’t directly pay the industrial carbon price and there are almost no costs to pass through the supply chain on to consumers.

- Costs for consumers are virtually nothing, because industrial goods have only a small impact on the price of finished consumer products.

- Industrial carbon pricing does not apply directly to individual consumers—only to the largest emitters of greenhouse gases in the country, like oil sands facilities, steel mills, and cement plants.

- Industrial carbon pricing has modest or negligible increases in the cost of industrial goods such as steel, which represent only a small portion of the final cost of consumer products people buy in Canada.

- For example, research finds that industrial carbon pricing that applies to the highest emitting steel plants in the country would still only add $0.12 to the cost of a refrigerator, and under $3 to the cost of a pickup truck.

- Industrial carbon pricing is low-cost for businesses, which also limits costs passed on to consumers.

- Industrial carbon pricing is designed to contain costs because industries only pay for emissions that exceed a specified limit, and if they outperform the limit they earn credits that they can sell for cash.

- Industrial carbon pricing imposes much lower costs on total emissions than consumer carbon pricing, around $10 or less per tonne of emissions against a carbon price of $95 per tonne. At worst, these costs add roughly the price of a Timbit per barrel of oil, while some industries are even able to earn money, on average.

Additional Resources

- Insight | Industrial carbon pricing has negligible impacts on household costs—and in some cases is a benefit

- Resource page | Industrial Carbon Pricing

- Media Backgrounder | About Carbon Pricing in Canada

- Explainer | The differences between industrial and consumer carbon pricing

- Insight | New analysis shows how Canada’s industrial carbon pricing protects competitiveness and profitability

- Video | Ask Me Anything: Industrial carbon pricing webinar