Visuals

Presentation

Download the presentation of the report.

Data visualization

See our report for context. All text and graphs are Creative Commons licensed and free to use with attribution.

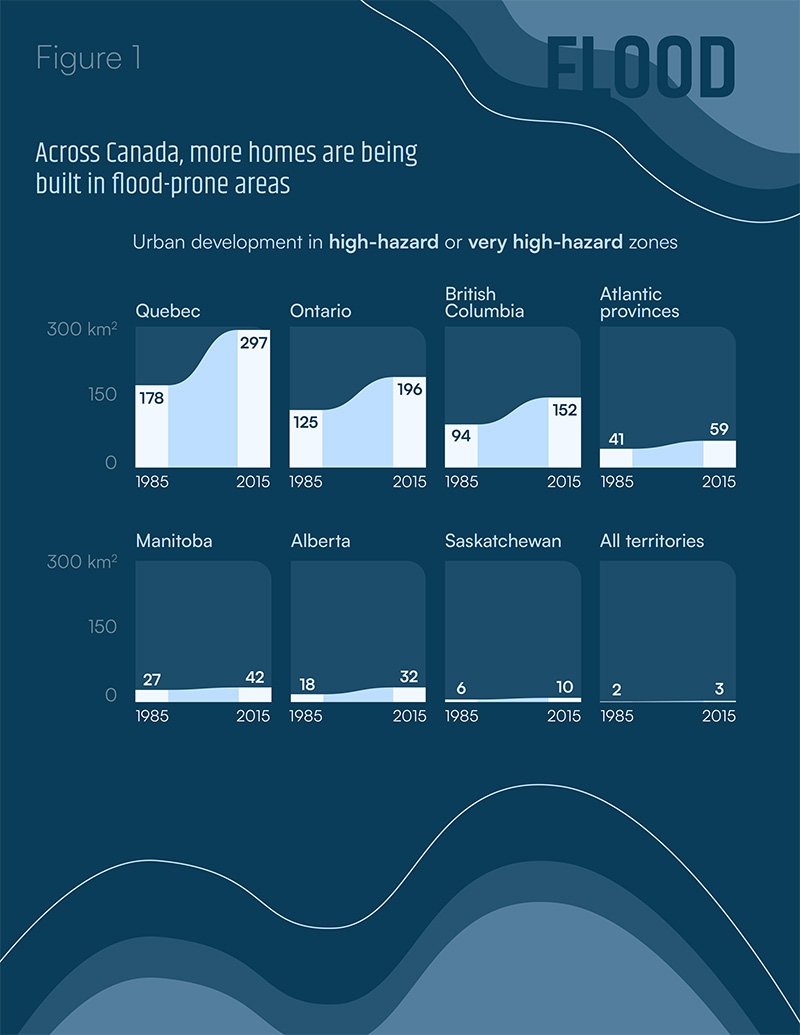

Figure 1

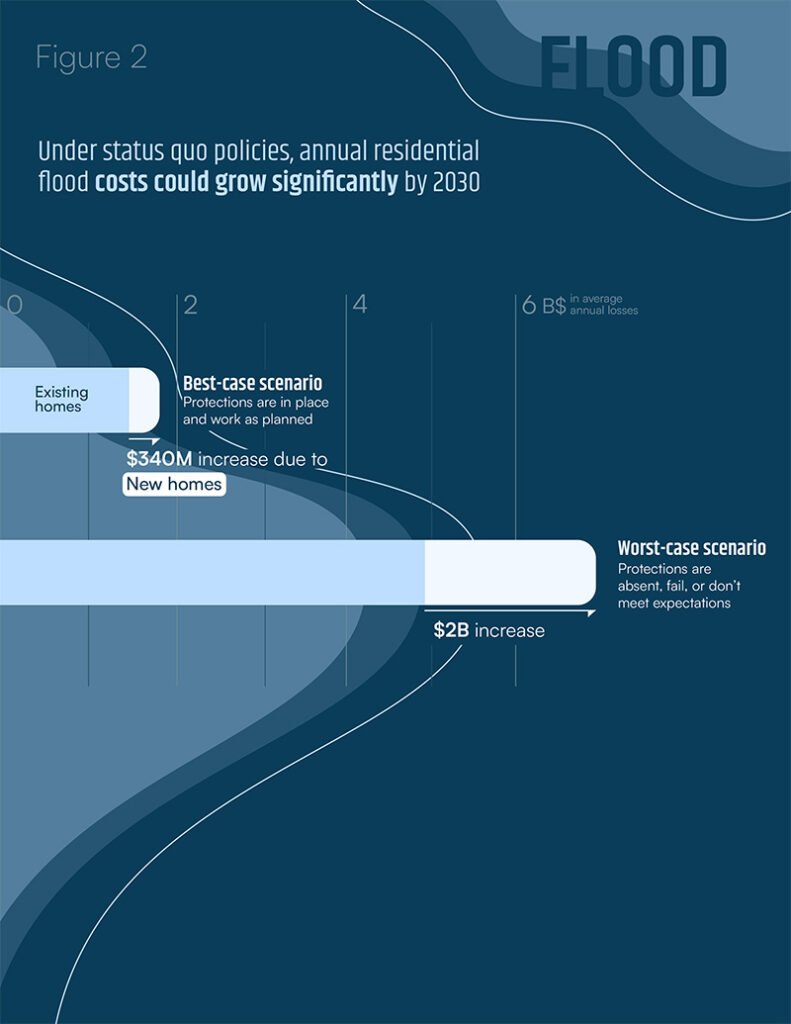

Figure 2

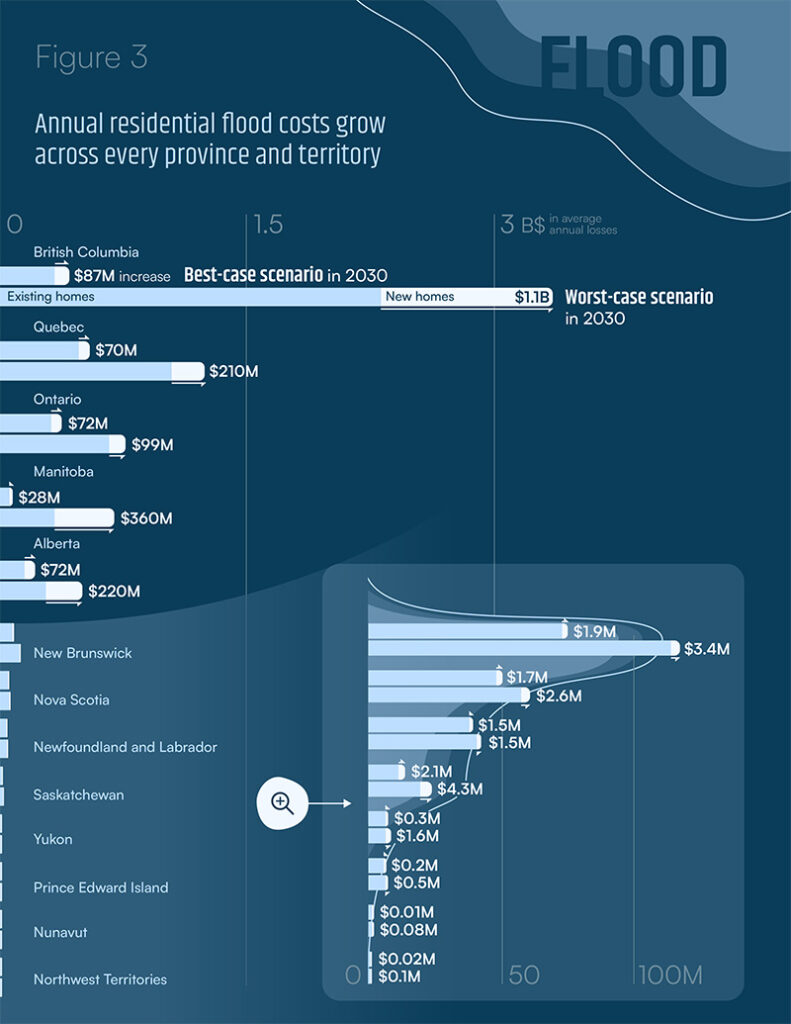

Figure 3

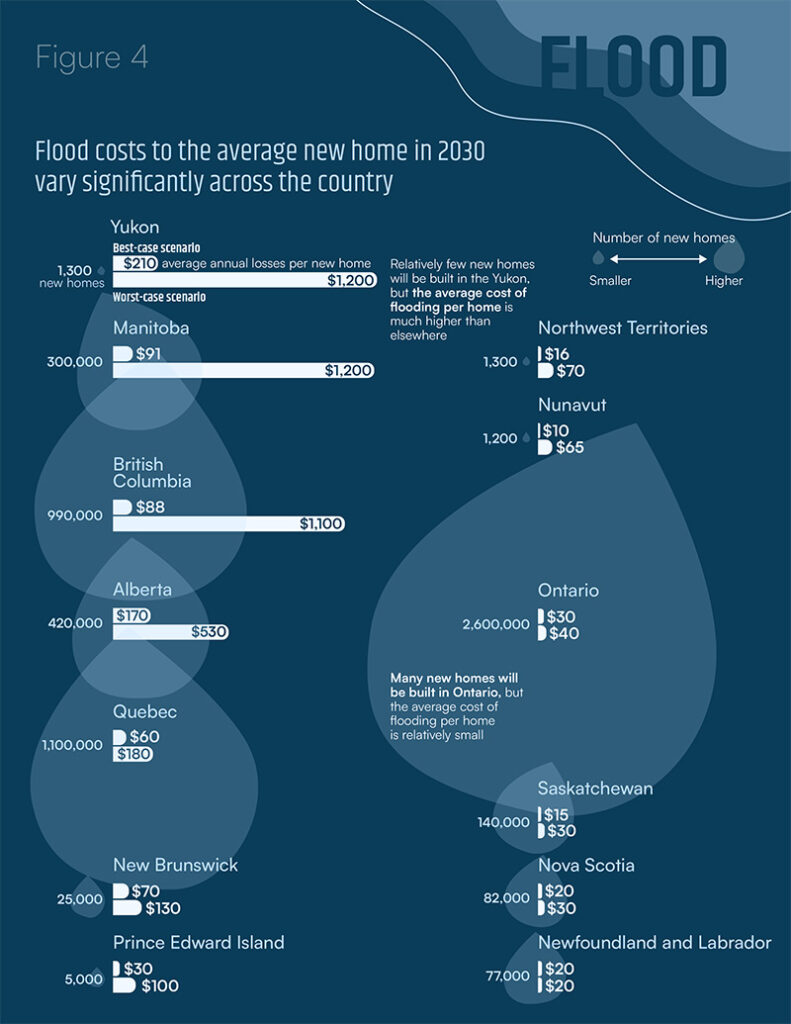

Figure 4

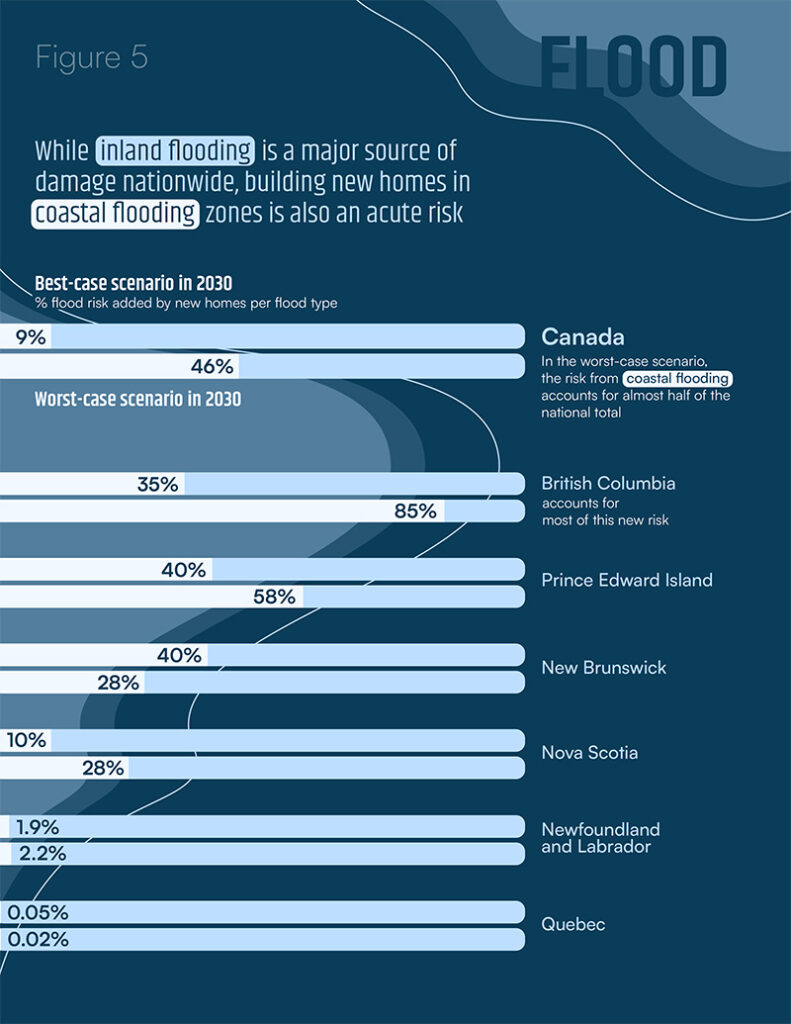

Figure 5

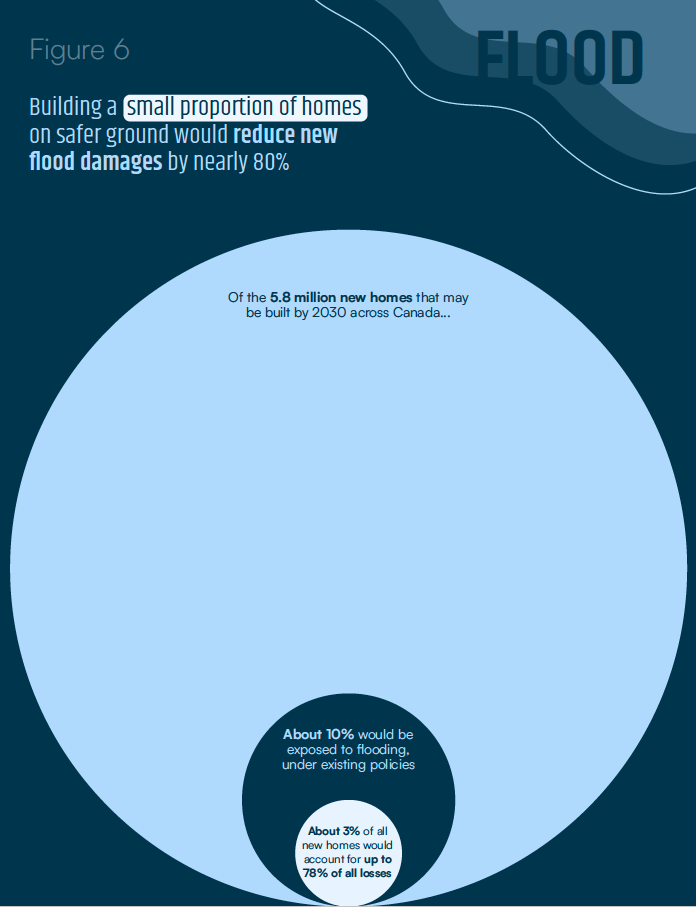

Figure 6

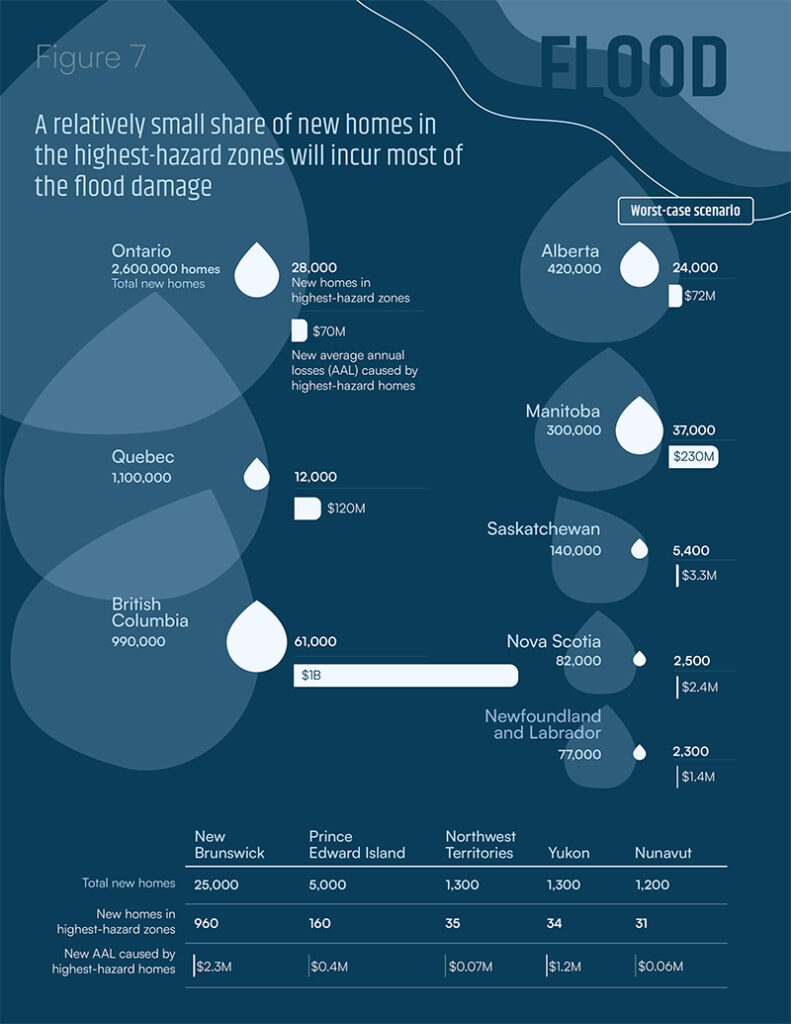

Figure 7

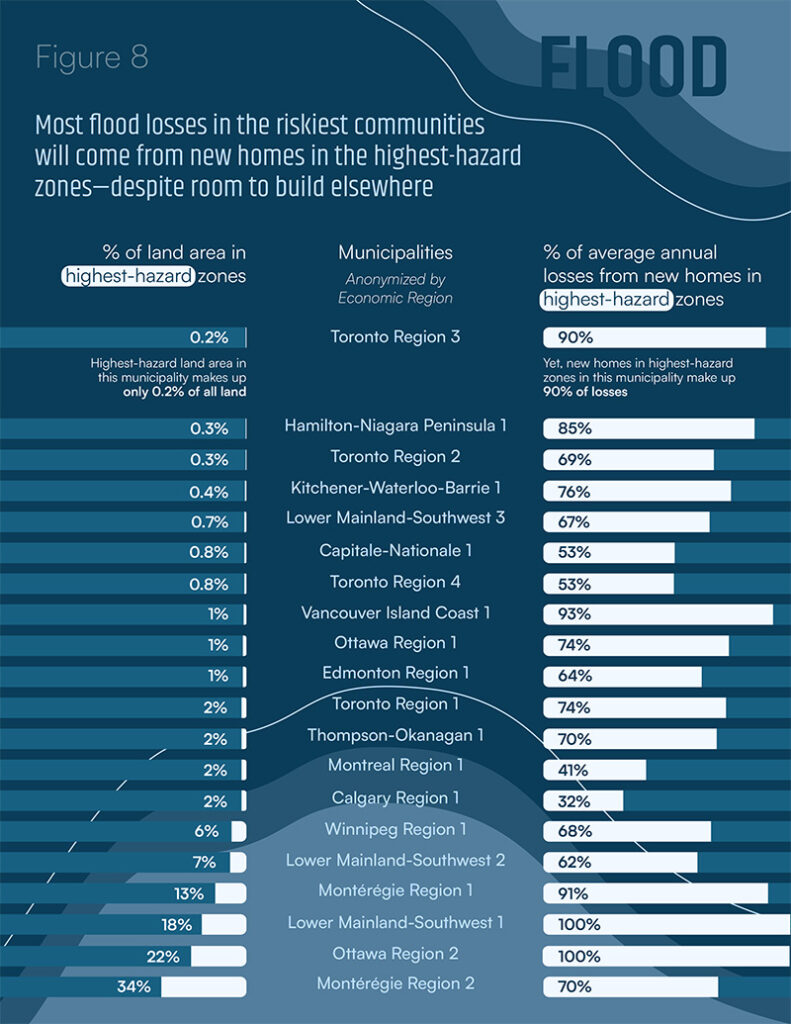

Figure 8

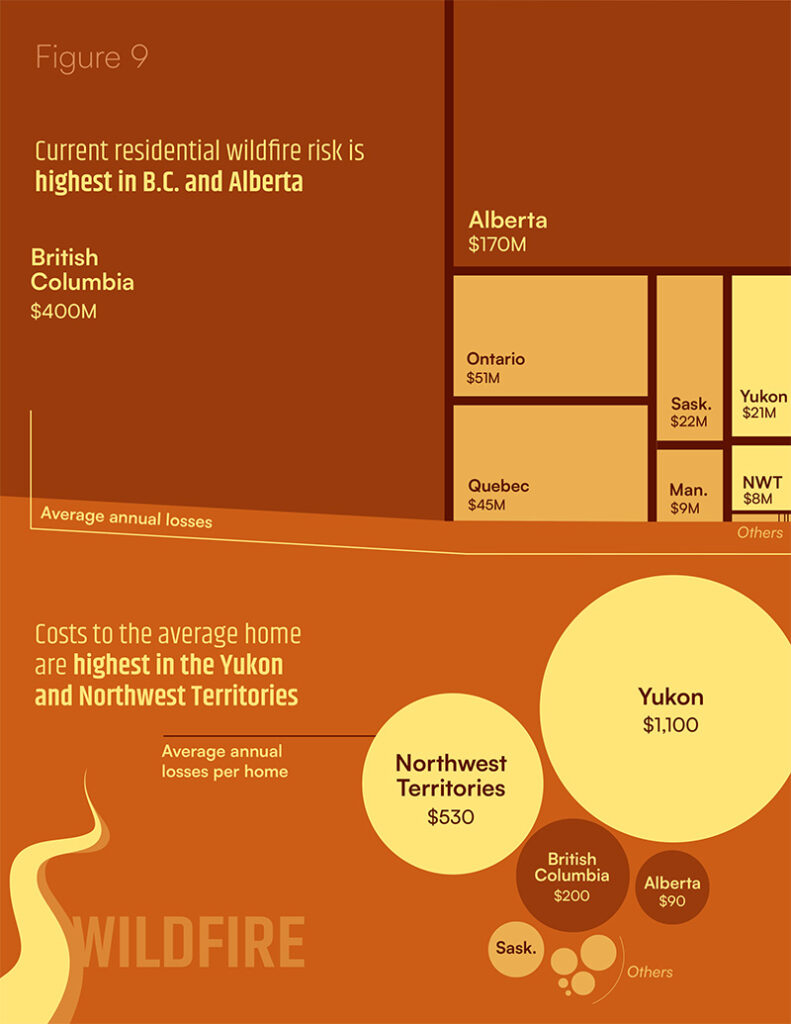

Figure 9

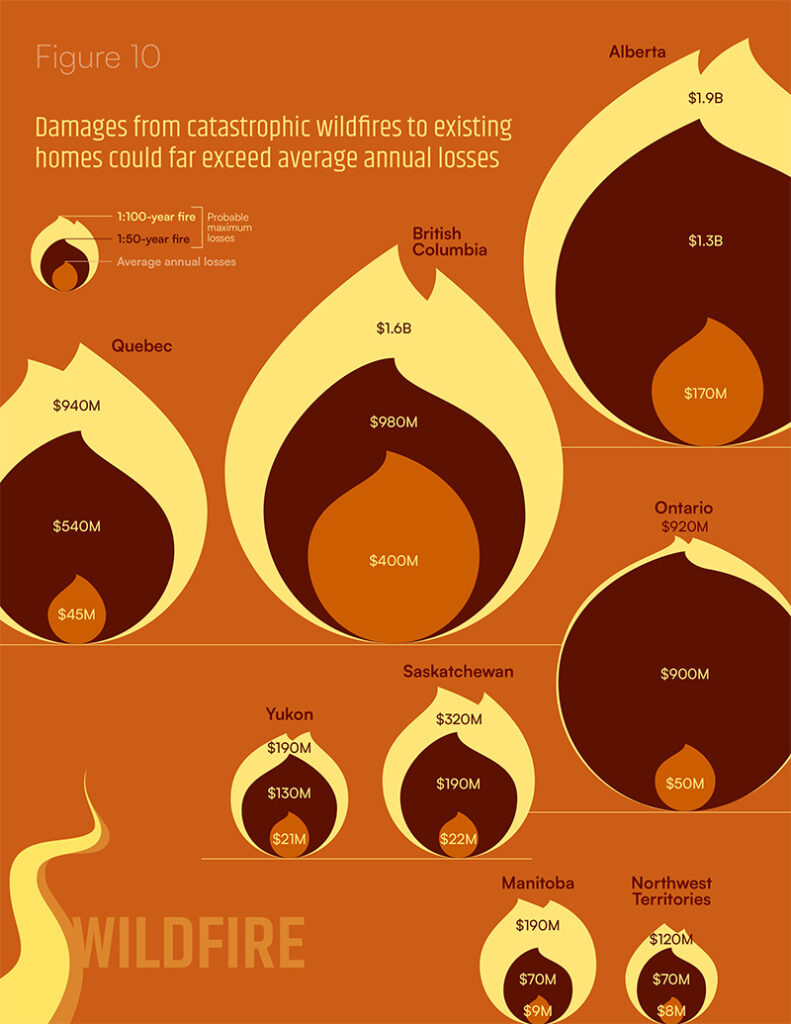

Figure 10

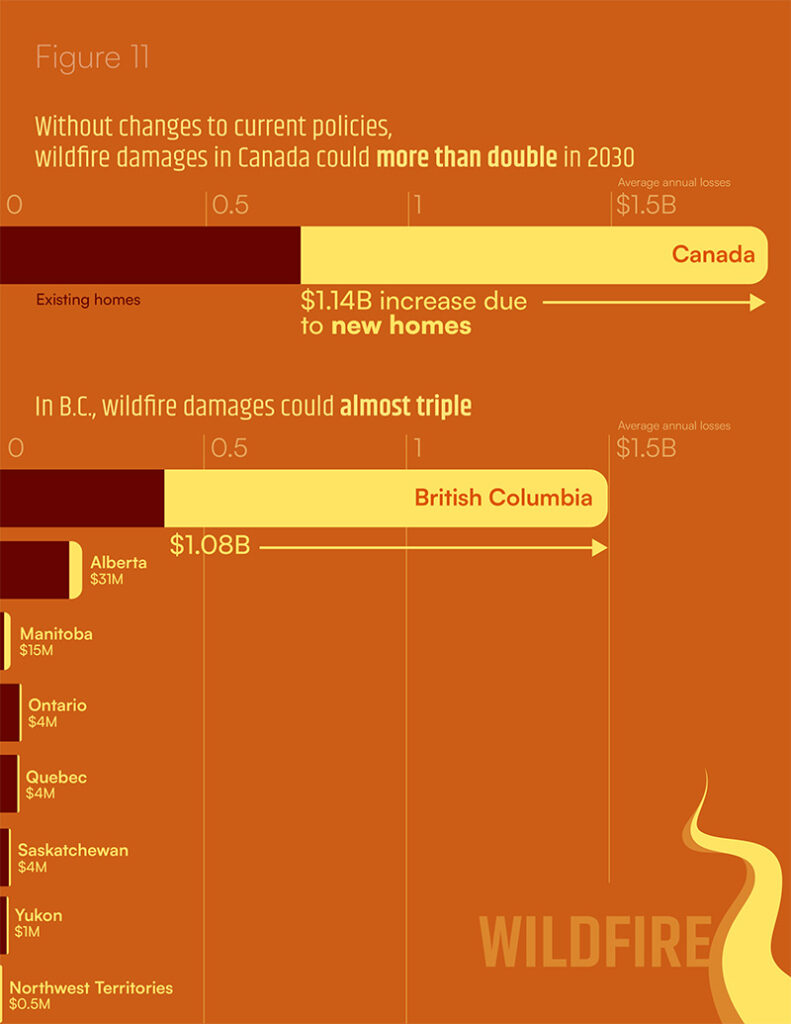

Figure 11

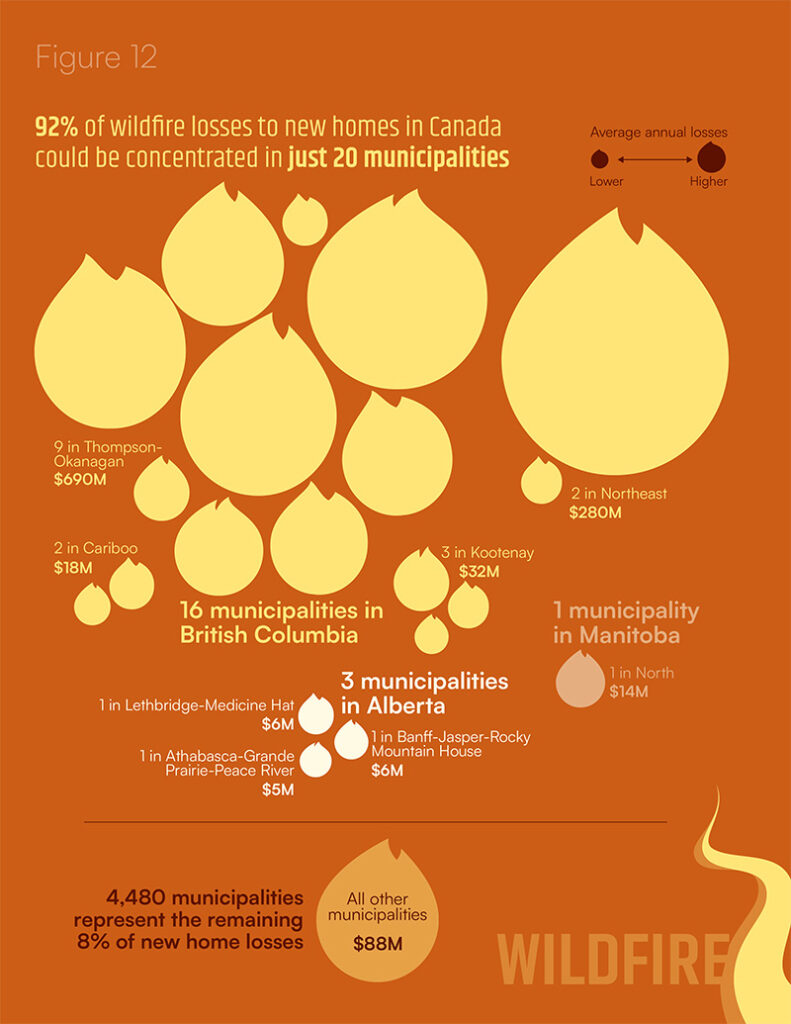

Figure 12

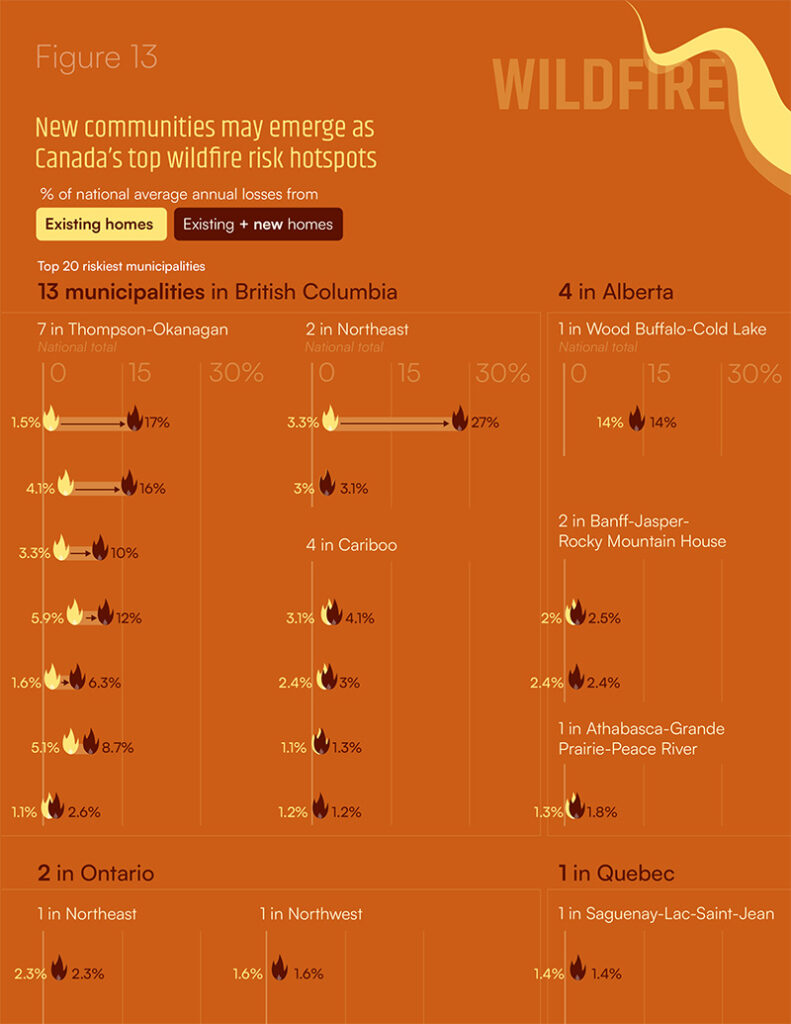

Figure 13

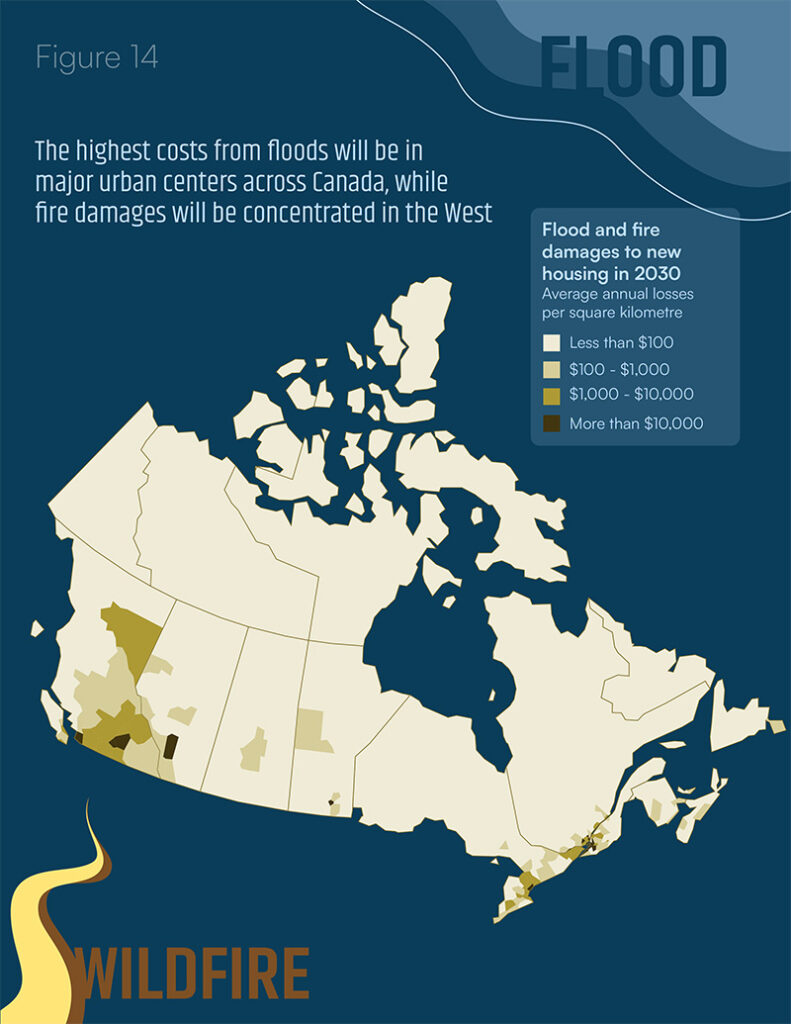

Figure 14

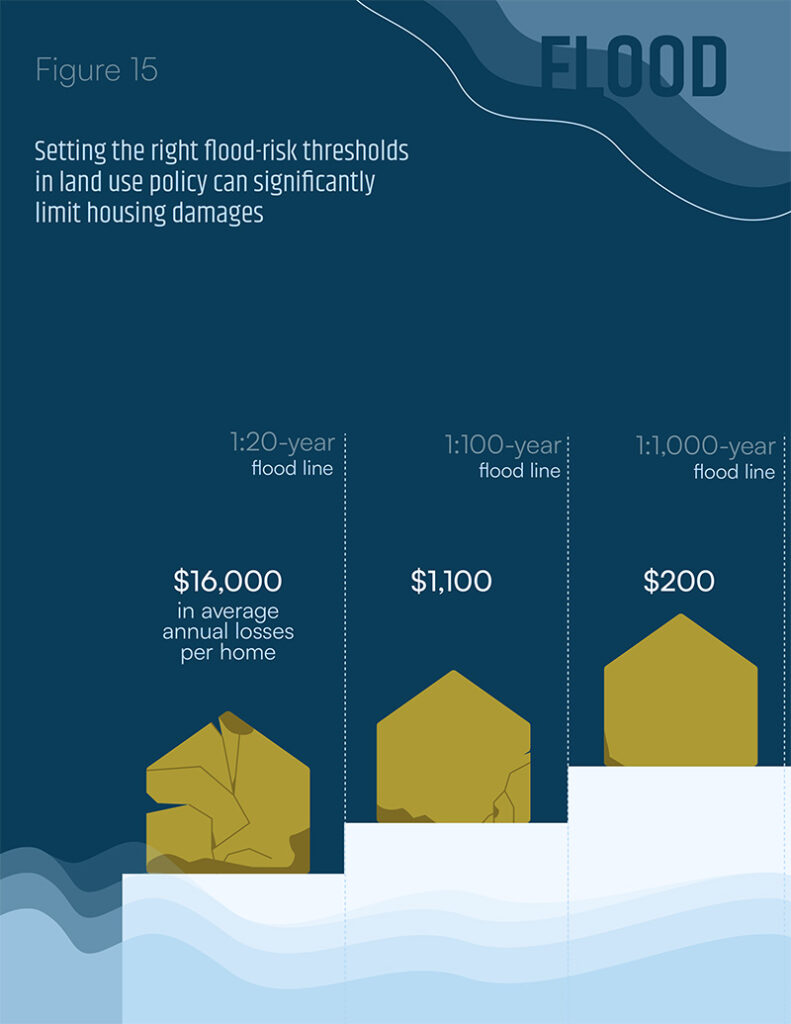

Figure 15