About the Energy Transition Technology Profile series: These profiles draw on, and update, the Institute’s analysis of specific safe-bet and wild-card technologies that are driving Canada’s clean energy transition.

Strengths and cautions

Could play an important role in decarbonizing Canada’s heavy industry and oil and gas sectors.

Has received significant government funding and policy support.

Only commercially viable for a subset of heavy emitters, and not to be confused with more-uncertain unconcentrated carbon capture (e.g., for natural gas-fired electricity).

Significant deployment depends on policy certainty.

What is concentrated-stream carbon capture?

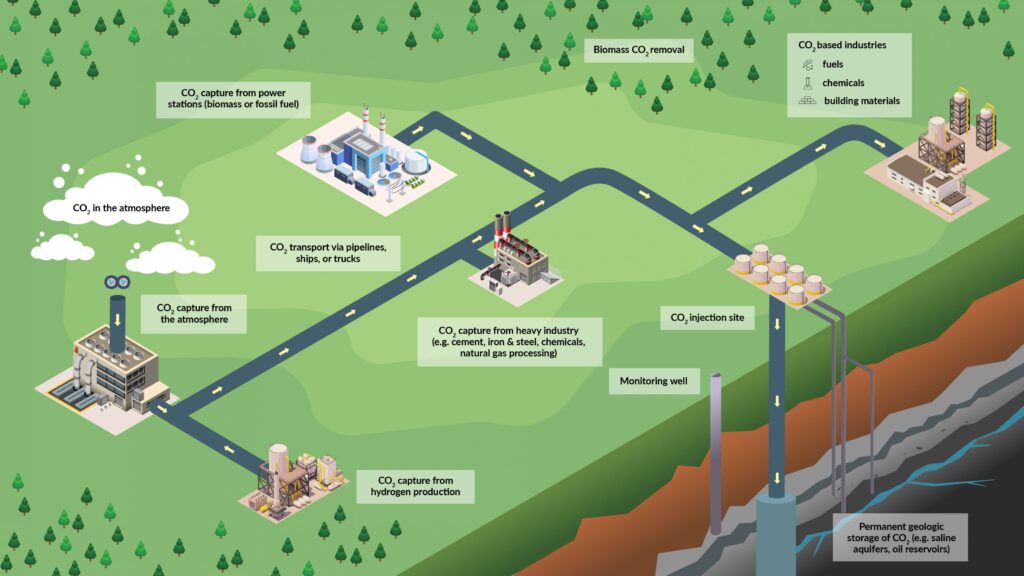

Concentrated-stream carbon capture is one subset of a range of pollution-capturing technologies gathered under the broad category of carbon capture, utilization, and storage (or carbon capture for short). While most energy transition technologies stop carbon pollution from happening in the first place—for example, by using hydropower to generate electricity instead of coal—carbon capture technologies work by reducing emissions while an industrial process is underway or even once emissions are in the atmosphere. The captured carbon dioxide is then either sequestered underground (sometimes, controversially, injected into oil wells to enhance oil recovery) or converted into fuels or other products.

The most mature, “safe bet” technologies remove carbon dioxide from the highly concentrated waste stream of an existing industrial process. Other carbon capture technologies are at much earlier stages of readiness. Attempting to capture carbon from unconcentrated sources, such as combusted natural gas or filtering it from the ambient air (direct-air capture), is a much more technically challenging task. These other applications are therefore still considered “wild cards.”

Why does it matter now?

Concentrated-stream carbon capture could play a crucial role in decarbonizing the heavy industry and oil and gas sectors. For example, in the Canadian Climate Institute’s analysis of a range of scenarios in which Canada’s oil and gas sector reduces emissions to 110 megatonnes in 2030, carbon capture contributes between 17 and 50 megatonnes of those emissions reductions. Beyond 2030, the Institute’s modelling of Canada’s net zero pathways foresees a role for carbon capture (including concentrated-stream carbon capture) in all scenarios, though the size of the overall role covers a wide range as well—anywhere from 1 to 29 per cent of all emissions by 2050.

Carbon capture’s importance for decarbonizing a given sector depends on how quickly technology can advance and costs can come down, but also the extent to which that sector has access to cost-competitive alternatives. For some emissions-intensive industries such as cement production, concentrated-stream carbon capture may be a central pathway to net zero. Heidelberg Materials is installing a carbon capture project at a cement plant near Edmonton. The project will create North America’s “first carbon-neutral cement plant.”

In oil and gas, both federal and provincial governments have continued to invest heavily in these technologies, and Canada’s oil sands sector has proposed to use concentrated-stream carbon capture in a central role to reduce its emissions, specifically to produce hydrogen for bitumen upgrading to synthetic oil, and for desulfurization. The federal government has also earmarked investment tax credits of up to 50 per cent specifically for carbon capture projects. These tax credits, along with other measures like industrial carbon pricing and carbon contracts for difference, are helping to shore up the business case for the technology.

As emissions reduction objectives increasingly become the backdrop of the global economy, innovations in all types of carbon capture, including concentrated-stream technologies, will take on increasing importance. And carbon capture could be particularly important for Canada, which has the technical expertise and geological attributes necessary to become a major player.

This work has already begun, with a handful of carbon capture projects up and running in Canada and capturing around four megatonnes of carbon dioxide per year. After years of sluggish growth, a new wave of concentrated-stream and other carbon capture projects is seen as a crucial next phase for the technology, with close to 390 carbon capture developments of various kinds in the project pipeline globally, including 26 projects now underway in Canada and expected to begin operating by 2030.

Eavor’s early successes are potentially big news for Canada, since Eavor is a Calgary-based company developed by veterans of the oil patch repurposing oil-and-gas drilling technology. As the company’s chief executive John Redfern told The Globe and Mail, “This is our shot. If we move now, Canada can be a world leader in geothermal technology.”

Is it a safe bet or wild card?

We consider concentrated-stream carbon capture a safe bet in contexts where the technology is applied to a point source with a consistent and concentrated stream of carbon pollution. While deployment experience with the technology beyond these applications is still in its early stages, from a technical perspective these kinds of carbon capture applications are viable now for certain industrial processes that produce highly concentrated carbon dioxide streams. Examples of concentrated-stream carbon capture include formation gas cleaning, which the Norwegian oil company Statoil has used since 1996, applications on ethanol production in the United States, and a project in planning stages at an autothermal hydrogen production complex in Edmonton.

Modelling shows that concentrated-stream carbon capture is commercially viable on a pathway to net zero. In general, costs are significantly lower when the concentration of carbon dioxide in the source’s waste stream is higher—the cost per tonne can vary from $80 to $300 depending on this variable. In the case of Canada’s oil sands industry, at least eight per cent of the emissions needing to be abated are at concentrations high enough to be potential candidates for concentrated-stream carbon capture at present, while 49 per cent are at low concentrations that would require significant declines in technology costs and a carbon price of at least $170 per tonne to be viable.

Other applications of carbon capture, including carbon capture applied to electricity generation, remain wild cards at present, and their potential usage varies widely. SaskPower ran an early pilot project at a coal-fired power plant in Saskatchewan, but its results were mixed and no further full-scale projects for coal or gas plants have proceeded since, despite considerable interest and planning.

What challenges must it overcome?

The first wave of carbon capture facilities now up and running have largely underperformed. Though technically capable of capturing and storing carbon dioxide as planned, few of these pilot projects have delivered at the scale promised, and the high cost of the technology and its high energy intensity have hampered the industry’s expansion. “So far, the history of [carbon capture] has largely been one of unmet expectations,” a recent International Energy Agency report concluded. “Progress has been slow and deployment relatively flat for years.”

Another challenge that concentrated-stream carbon capture faces is in the complexity and customized requirements of each facility. The capture portion of a carbon capture facility can account for up to 80 per cent of the cost (transportation and sequestration comprising the other 20 per cent), and the application of capture technologies almost always has to be customized to the facility, which adds to the complexity of the project and increases the risk of escalating costs.

Given the high capital and operating costs of this technology, investor confidence depends on policy certainty. In Canada, even with an investment tax credit of 50 per cent on upfront costs, policies like industrial carbon pricing must be seen as durable.

What are the next steps for policy makers?

Already, a range of government policies and incentives support carbon capture technologies. The U.S. government’s recent Infrastructure Act and Inflation Reduction Act have contributed billions of dollars in subsidies and loans for carbon capture technologies, with direct subsidies of US$60 per tonne of carbon dioxide for carbon capture with enhanced oil recovery, US$85 per tonne for carbon capture to permanent sequestration, and US$130–US$180 per tonne for direct air capture and storage if domestic wage requirements are met.

In Canada, both federal and provincial governments have invested billions in the technology, including a new 50 per cent investment tax credit for carbon capture projects and a grant of 12 per cent of eligible costs through Alberta’s Carbon Capture Incentive Program. And Canada’s industrial carbon pricing systems provides both an incentive to reduce emissions and a potential revenue stream for emissions-reducing projects like carbon capture.

While government backing is helpful for many emerging technologies, it is particularly important for carbon capture due to high up-front costs and the competitiveness pressures faced by industrial sectors that produce globally traded commodities. And policy durability matters. Tools like long-term price guarantees through carbon contracts for difference can help alongside other efforts from policymakers to reassure investors of the stability of their climate policies.

In Canada, the oil sands industry has called upon the federal government to provide significant direct funding and tax credits for its proposed projects, asking for as much as 75 per cent of the total cost to meet its 2030 emissions target to be subsidized. Governments should be cautious, however. While there can be a case for subsidies in the interest of protecting competitiveness, driving innovation, and reducing emissions, governments must also prioritize the prudent use of public dollars.

Furthermore, policymakers should note that carbon capture may be a safer bet in economic sectors—like cement, ammonia fertilizer, and other chemicals production—that will be needed for the long term and that face trade and competitiveness pressures to decarbonize, compared to its use in industries such electricity generation, where the technology must compete on price with other options, and oil and gas, where demand is expected to decline through the energy transition.

Profile text by Chris Turner.