In March 2023, the Sustainable Finance Action Council (SFAC) released its Taxonomy Roadmap Report, featuring a framework to establish standardized and science-based definitions of climate-compatible investments. The Canadian Green and Transition Financial Taxonomy Framework, backed by Canada’s 25 largest financial institutions, is key to aligning capital flows with Canada’s climate targets and economic opportunities.

The Institute for Sustainable Finance and the Canadian Climate Institute contributed to the Report as independent core knowledge partners.

What is a Climate Investment Taxonomy and why does it matter?

- Think of it as a giant “sorting hat” for the financial system: A classification system that identifies activities or assets that contribute to environmental and/or social objectives.

- Taxonomies improve clarity within the market by promoting a shared understanding of what constitutes a “sustainable” activity (in this case: green / transition).

- It’s a critical step in securing Canada’s competitiveness through our transition to net zero. The Framework is grounded in the global target of 1.5C degrees—all thresholds and criteria are aligned with that target. SFAC intentionally set this high standard as this is critical to building and maintaining credibility in international capital markets.

- The taxonomy is not mandatory. It is a tool for providing clarity within our existing system.

How will this benefit Canada and Canadians?

- This made-in-Canada taxonomy approach could reap huge benefits for our economy, including the thousands of Canadians employed by high-emitting sectors.

- Having common definitions for green and transition projects is how we can get global investment to flow into the areas we most need it.

- That includes bolstering promising new sectors (e.g. green hydrogen) and helping reduce emissions in our most energy-intensive sectors, which will make them more competitive.

How does Canada’s approach differ from what the EU or other countries have done?

- The differences come down to the scope of activities they cover. The EU Taxonomy is essentially a green taxonomy that incorporates limited elements of transition.

- The Canadian Taxonomy aims to expand upon the approach of the EU Taxonomy and many others by being one of the first to substantively identify and define transition activities.

What’s the difference between the “green” label and the “transition” label?

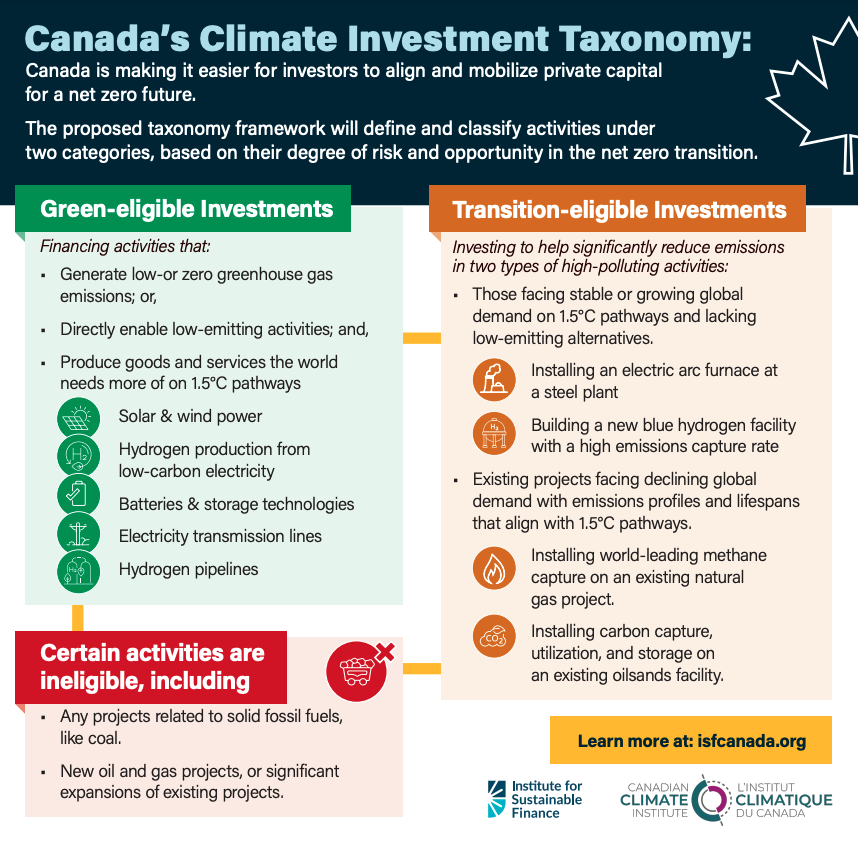

- “Green” projects are low or no carbon solutions that help accelerate our transition to net zero (e.g. Renewables, clean hydrogen, EV batteries).

- “Transition” projects significantly reduce emissions from high-emitting sectors. There are three key criteria:

- Short-to-medium life span (not lock in carbon emissions for long term)

- Doesn’t make it harder / more expensive to transition away

- Significantly reduce emissions aligned with net zero target

- To achieve our climate goals, we need investment in BOTH of the areas.

- Refer to this Climate Taxonomy infographic for more detail.

What was involved in this process? How did you arrive at this framework?

- The framework began as one of the key recommendations from the Expert Panel on Sustainable Finance.

- The work was initially led by the CSA Group and then came under Sustainable Finance Action Council when it was established.

- SFAC created a technical expert group including Canada’s largest financial institutions, and brought in the Institute for Sustainable Finance and the Canadian Climate Institute as knowledge partners to help ensure the taxonomy framework’s categories were grounded in evidence and aligned with Canada’s climate targets.