Introduction

Longship is envisioned to be a network of carbon capture and storage projects that could serve as one of Europe’s first large-scale initiatives to tackle industrial decarbonization, facilitating emissions reductions from heavy industries that are not able to fuel-switch or electrify. The megaproject has received considerable technical, operational, and financial support from Norway’s public sector, with the government expected to cover some two-thirds of total phase-one project costs, valued at over C$3.5 billion.

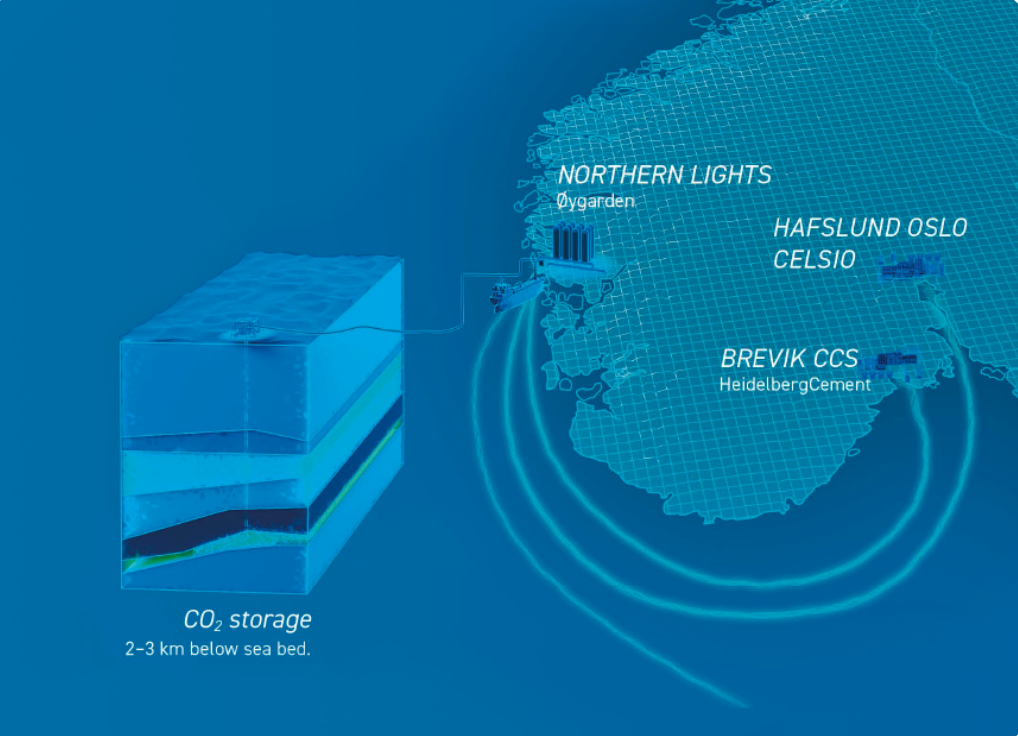

The Longship network will initially link two sub-projects that capture carbon dioxide from cement and waste-to-energy plants, with a storage plant in the North Sea. Norway’s state-led oil and gas company Equinor, along with oil majors Shell and Total, are partners to the Northern Lights portion of the project, the transport and storage facility, bringing significant experience in carbon dioxide storage in depleted offshore gas reservoirs. Construction of the Northern Lights terminal began in 2021, with the first phase expected to be complete by mid-2024, offering an initial storage capacity of 1.5 megatonnes of carbon dioxide per year over 25 years. The aim of phase two is to increase storage capacity to 5-7 megatonnes per year by 2026.

Longship’s first sub-project is a carbon capture plant at a cement factory located in Brevik, owned by Norcem-Heldelberg, a subsidiary of Germany’s HeidelbergCement. The project aims to use surplus heat to capture 400,000 tonnes of carbon dioxide per year, a third of the emissions caused from producing 1.2 megatonnes of cement per year. The second sub-project is a waste-to-energy plant located in the capital Oslo, the Hafslund Oslo Celsio (formerly named the Fortum Oslo Varme). The sub-project aims to match its sister’s capture rate at 400,000 tonnes of carbon dioxide per year, with emissions captured from the waste combustion process. This sub-project tried but failed to obtain additional financial support from the European Union’s Innovation Fund, meaning that the Norwegian government had to commit additional financing to cover the investment gap.

Captured carbon dioxide from the two plants will be transported by ship to the Northern Lights reception terminal in Øygarden municipality, and then by pipeline to the injection well where storage will take place beneath the seabed. This portion of the project—the transport and storage infrastructure—aims to eventually become commercially profitable based on a tariff paid by emitting firms to transport and store their captured carbon dioxide.

Figure 1: Longship includes the full carbon capture chain through sub-projects linking captured carbon dioxide with storage

Longship provides an example of hands-on, targeted support for a large-scale emissions-abatement initiative, where the government works directly with its private-sector partners on project design, construction, implementation, and marketing. While subsidizing the lion’s share of phase one of the project, the government has said that phase two of the project, or any additional expansions, will need to be privately funded. The consortium of partners has already promoted the Northern Lights sub-project as commercially viable, aiming to become a storage provider for carbon captured from industrial sites across Europe.

Description of the policy

Norway has a long history of state ownership and other stakes in strategic industries, and this economic model has propelled the nation to one of the top-10 richest countries in the world. At the same time, Norway is known for its successful wealth distribution policies—including intergenerationally—made possible through its sovereign oil fund that manages revenue contributions from its petroleum sector. This reliance on its fossil fuel resource abundance, coupled with strong climate commitments (currently to cut emissions by at least half by 2030 compared to 1990 levels), has driven considerable interest in carbon capture and storage technology over the last two decades. Norway is now mobilizing its existing expertise, its ready access to North Sea storage, and a belief that a carbon capture and storage market will emerge as regional carbon pricing and other climate policies accelerate.

The Norwegian government launched the project through a white paper in September 2020, committing NOK 16.8 billion (C$2.32 billion) out of the total planned investment of NOK 25.1 billion (C$3.47 billion). Parliament approved the proposal at the end of that year, with the funding to roll out between 2021 and 2034, covering both capital and operational costs. This represents the Norwegian government’s largest ever investment in a single climate project. But the government’s support stretches beyond a financing role, to addressing other potential barriers to development, such as regulatory challenges.

State enterprise Gassnova was specifically established in 2005 to advance research and development into carbon capture and storage, and is now acting as the technical advisor to the government for Longship. This includes conducting the pre-feasibility study, leading in overall planning activities, and managing contracts with industry partners. Gassnova is also responsible for communicating results, and has committed to providing lessons learned from the regulatory and development processes to facilitate demonstration. Several other Norwegian public sector bodies are also heavily involved in the development of Longship, with several state agencies and directorates handling regulatory roles in addition to municipalities and county governors. The government is also involved as a project integrator, coordinating various public and private partners.

While phase one of Longship will connect only two plants capturing carbon dioxide in Norway with the Northern Lights facility, the network is envisioned to expand in later years. For the second phase, Northern Lights is offering commercial carbon storage services to companies across Europe, where emitting firms would pay a service charge for carbon dioxide handling and storage. European industrial sites that choose to capture carbon dioxide will be able to pipe or haul its liquified form onto ships that transport it to a facility on the Norwegian continental shelf before it is injected into permanent storage sites 2,600 metres below the seabed. Northern Lights has identified over 90 suitable capture sites, and there is already interest from industrial plants in eight countries, spanning sectors such as steel, biomass, and hydrogen.

Norway is promoting the project as a way to jumpstart a European carbon capture and storage market. While withdrawing its financial support in this commercial phase of the project, the government remains involved in bilateral relations, making agreements between participating governments a prerequisite for Northern Lights’ carbon dioxide storage agreements. The Ministry of Petroleum and Energy is already in consultations with several governments, and has signed memorandums of understanding with Belgium and the Netherlands. This has paved the way for the first cross-border commercial agreement, signed in September 2022, that by 2025 will see up to 800,000 tonnes of carbon dioxide per year transported from Yara Sluiskil, an ammonia and fertilizer plant in the Netherlands, and stored.

While the Norwegian government is essentially designing and subsidizing a significant share of the project, it is simultaneously working to drive long-term demand for carbon capture. This includes a rising carbon price applied to fossil energy products such as petrol, diesel, and natural gas, currently slated to reach NOK 2000 (C$275) per tonne in 2030, up from NOK 590 (C$81) in 2021. The carbon price applies to sectors that are covered, as well as those that are not covered, by the European Emissions Trading System, with a pricing top-up currently applied to the former to reach the national benchmark.

While this strong carbon pricing trajectory will incentivize domestic industry to consider capturing their emissions, the carbon price applied within the European Union remains insufficient to do so. The targeted capacity at Northern Lights of 5-7 megatonnes per year by 2026 is a fraction of what is needed to help Europe decarbonize: a study by the University College London Energy Institute estimated it would require 230-430 megatonnes of carbon dioxide storage per year by 2030, increasing to 930-1,200 megatonnes of carbon dioxide storage per year by 2050 under a 1.5C-compatible scenario. For this reason, support-based policies are building in popularity under the European Commission, which has approved more state aid for carbon capture activities and also funds its own carbon capture and storage projects through its Innovation Fund.

Policy strengths and limitations

As the first large-scale carbon capture and storage project in the region, the Longship project has been called a “demonstration project,” helping to legitimize government support to test the technology as a climate change solution, including functionality, efficiency, and potential to scale. These types of public expenditures into clean technologies may help realize public benefits from innovation, including by building knowledge and related skills (the so-called “knowledge spillover” effect). The first-mover advantage—from being the first in Europe to enable cross-border carbon trade for storage—has also enabled the company to establish early partnerships and build a strong reputation in the market. Lessons learned may also bring down costs or remove other barriers that benefit future project proponents.

Many of the celebrated achievements of Longship thus far surround its success in overcoming financial and non-financial barriers to project implementation. While the large upfront capital costs of the project were identified as a significant barrier to development, the government has also helped to overcome other barriers to private-sector carbon capture development, such as regional red tape. This has meant trailblazing new public-private partnership models, and navigating a path to a more efficient regulatory process.

Strengths

- The project represents a strategic and specific investment with measurable results.

Unlike government policies that provide blanket support to industry, such as tax breaks or energy rebates, Longship is an example of a government targeting a specific project with measurable results and a potential revenue stream. These results include carbon capture as a key component of regional decarbonization, as well as tapping into the commercial opportunities of carbon dioxide storage across the region. As a public project, Longship defies market failures that prevented it from being realized by private actors, including high upfront capital costs, insufficient carbon price levels, and risks associated with the technology. In so doing, it targets a specific type, and volume, of climate change mitigation (i.e., 1.5 megatonnes of carbon dioxide captured per year), and supports clean technology innovation. It also relies on a science-based approach to target which technology type to support, with carbon capture present in all globally recognized scenarios consistent with limiting global temperature rise to 1.5C-2C.

- The government’s participation includes funding, designing, and managing the project through the full carbon capture and storage chain.

Recognizing that the concept of carbon capture does not work without a reliable storage option, the project has been designed to grow the entire carbon capture and storage chain in unison. Each component of the initiative is being considered as a separate sub-project, with the government establishing separate agreements with each industry player, thus helping to avoid cross-chain risk for private partners. While the model means that the government bears additional cross-chain risks related to the interface between the sub-projects, it protects private partners from weaknesses in other links of the chain. For example, if one of the capture projects were to fail, Northern Lights could find other carbon dioxide suppliers, or if Northern Lights were to fail, the capture projects could likely find a different storage provider without facing catastrophic loss.

- The project addresses a specific barrier to scale carbon capture and storage as a climate change solution: the availability of supporting infrastructure.

One of the identified barriers to carbon capture project development in Europe is uncertainty around transport costs and long-term storage options. Longship aims to address this well-known chicken-and-egg problem, where no industry emitter will invest in a capture project without the existence of a storage solution, and no company will develop a storage site without knowing that there is carbon dioxide to be stored. Longship will allow emitting firms to develop carbon-capture projects with the security of knowing there will be a reliable transport-and-storage option. The project has already mustered considerable interest from industrial emitters across Northern Europe.

- The project recognizes climate change as a global challenge, offering neighbouring countries a climate solution while also tapping into a emerging market.

As of 2021, there are over 50 carbon capture projects announced across Europe, offering an abatement potential of over 80 megatonnes of carbon dioxide per year. Many of these projects are considering Northern Lights for their storage requirements, particularly as the endeavour is several years ahead of other storage projects under development in Europe, such as the Port of Rotterdam Porthos Project. As a result, the project’s initial storage capacity is already oversubscribed if all agreements come to fruition. Longship also paves the way for blue hydrogen, where carbon is captured from the burning of natural gas in the production process. Equinor, for example, is already producing blue hydrogen in Hull, England as part of the Zero Carbon Humber carbon capture and storage project, and Northern Lights will provide a viable storage option for these types of endeavours. It should be noted that competition in the region is ramping up, with the U.K. investing £1 billion (C$1.66 billion) through a carbon capture infrastructure fund that is looking to develop two “hub and cluster” projects as early as 2025.

- The project helps address regulatory barriers.

Immature regulatory frameworks have been highlighted as a barrier to carbon capture project development worldwide. Working in lockstep with the federal government has allowed the project priority access through the regulatory process, and the government has demonstrated agility in shaping the system to facilitate project success—something that will help the next wave of carbon capture projects. Gassnova’s role in sharing lessons learned from the regulatory process has helped demystify the steps and shed light on potential hurdles in the Norwegian context. The importance of involving local authorities early in the process, for example, was highlighted as a key lesson learned due to the complexity and the sheer size of the carbon capture and storage projects. The Longship process has also helped shed light, and address hurdles such as zoning-plan permitting, consent for pipelines, and quay-to-offshore licensing. As a learning-by-doing model, the Longship project has already led to the development of a new licensing system for carbon dioxide storage. In addition, the government has now clarified reporting obligations for carbon capture to facilitate its international climate change reporting obligations.

Limitations

- The subsidy-based project relies on finite public capital to fund a technology with a mixed level of public support.

Longship has drawn criticism from some stakeholders who see public funding for the project as a form of fossil-fuel subsidy because it is an oil and gas consortium that hopes to benefit commercially from the storage and transport terminal. They note that the oil and gas sector has seen recent record profits and should not be given a share of finite resources from the public purse. Those critics also say that emissions-intensive companies should face regulations or carbon prices that incentivize carbon capture adoption—rather than relying on public funds. Some stakeholders also slam carbon capture as an inefficient or ineffective way of reaching net zero, believing that emissions should instead be reduced at source. While the government has doubled-down on carbon capture as “absolutely necessary” to reaching climate goals, they have also admitted that there is “no guarantee” that Longship will be a success from a climate change perspective.

- The ultimate success of the project hinges on the shape that domestic and international climate policy take.

Because the carbon price signal is currently insufficient to incentivize carbon capture development in Europe, additional government support is currently needed. The ultimate commercial success of the Longship project will hinge on the regulatory stringency and/or subsidy envelopes from other governments. This means that both ongoing and accelerating carbon price levels and government support are needed to see the carbon capture market take off. There are promising trends here, with four of the seven large-scale projects that were awarded funding in 2021 under the EU-level Innovation Fund considering carbon dioxide storage through Northern Lights, and seven out of seventeen winners from the 2022 Innovation Fund round including a carbon capture component. The upcoming third call will see a significant increase in funding, with the European Commission aiming to invest €3 billion (C$4.3 billion) towards clean tech projects.

Lessons for Canada

Canada’s oil and gas sector has been an early mover in carbon capture, and over three megatonnes of carbon dioxide are already being captured each year from Shell’s Quest Project, Alberta Carbon Trunk Line, and the SaskPower Boundary Dam Project. The Canadian federal government’s Emissions Reduction Plan set a target of capturing at least 15 additional megatonnes of carbon dioxide annually by 2030, including through a generous investment tax credit slated to be applied from the 2022 tax year onward.

Nevertheless, the Longship initiative provides policy lessons that span beyond carbon capture and storage, with several of these lessons applying to any large-scale project that the government directly supports.

- Target the most cost-effective projects to deliver public support.

The most cost-effective publicly funded projects will leverage private sector investment. Norway’s partnership with private industry helps cover a third of project costs, while project operation and expansion will be handed over to the private sector after phase one. Norway has also coupled its carbon capture investment with a commitment to a sharp rise in the carbon price. This will help drive down the required levels of support for carbon capture moving forward, complementing the initial investment by driving demand for carbon dioxide storage. The government also points to long-term economic gains through Longship’s potential to create jobs, and also provide a source of foreign capital as a cross-border carbon dioxide storage service provider.

- Target all barriers to project development, not just financial barriers.

Longship demonstrates that non-financial barriers are equally important to address as financial barriers. The Northern Lights consortium of oil majors already had the capital for carbon capture ventures, but they cited the partnership with the Norwegian government as fundamental to the project, in part because it would help overcome regulatory hurdles. While looking to develop the carbon capture industry in Canada, the government should identify and remedy non-financial barriers to implementation. These include hurdles related to supporting infrastructure, such as carbon dioxide transport.

- Leverage Canada’s comparative advantages and existing talent, skills, and experience.

While Longship is often labelled a demonstration project, it leverages over 20 years of experience in carbon capture and storage. Norway started capturing carbon dioxide and storing it under the continental seabed using depleted offshore gas reservoirs as early as 1996. Norway had already built up much of what was needed for project success, including technical expertise and industry know-how. Canada also has considerable experience and expertise in carbon capture technology, but our country also has considerable advantages in other areas, including an abundance of clean hydro power, preferential access to the United States market, and a wealth of natural resources that include critical minerals. These natural advantages should factor into any large-scale publicly funded project.

- Facilitate capture from across Canada’s heavy industries, not just the oil and gas sector.

Phase one of the Longship project includes carbon dioxide captured from a domestic waste-to-energy and cement plant, recognizing carbon capture and storage as the only currently viable solution for those plants to remain in operation in a decarbonizing economy. Northern Lights is targeting a European market that will provide a storage service to customers capturing carbon from a variety of facilities. Therefore, although Norway is utilizing the strengths and expertise of the oil and gas sector to build Northern Lights, the project broadens the scope of impact across the country’s—and region’s—industries beyond oil and gas. The oil and gas sector nevertheless continues to be a significant contributor to Norway’s emissions, accounting for around a quarter of the country’s greenhouse gas emissions. Norway is in the process of strategizing how to cut emissions from the oil and gas sector, which it said will include a combination of shutting down certain oil fields, carbon capture and storage, and electrifying operations where possible.

Conclusion

Longship offers an example of a government providing holistic, tailored, large-scale support to a particular climate project, where the public sector works directly with its private-sector partners on project design, construction, implementation, and marketing. The public ownership stake is seen as a strategic investment, tapping into Norway’s existing skills and advantages, leveraging over 20 years of experience in carbon capture and storage. The investment places a bet on the government’s expectation that the market for carbon capture will grow as domestic and regional carbon pricing continues to strengthen, and the European Union offers increasing levels of financial support to its member states for carbon capture and storage projects.

Given lessons learned in the Norwegian context, Canada should optimize its comparative advantages when making strategic investments in climate-related and carbon capture projects. It should also consider its existing policy landscape when making decisions about the level of support to offer a project, given that regulations and carbon pricing policies will already be pushing emitters to invest in clean-technology solutions, taking care to avoid crowding out private-sector investment. Ultimately, the scope and scale of complementary climate policies will set the pace of the Canadian and global clean energy transition, shaping related market opportunities.