Achieving Canada’s climate targets requires transformational emissions reductions in its historically emissions-intensive sectors including oil and gas. Canada also needs to increase private and public investments in clean growth projects by $80 – $110 billion annually to meet its climate targets. In March 2023, the federally appointed Sustainable Finance Action Council recommended that Canadian governments establish a Climate Investment Taxonomy to help support the needed investments. In effect, the taxonomy would serve as a standardized framework to help financial markets assess which projects and investments can help reduce fossil fuel emissions from hard-to-decarbonize sectors in line with Canada’s climate goals and global 1.5°C scenarios.

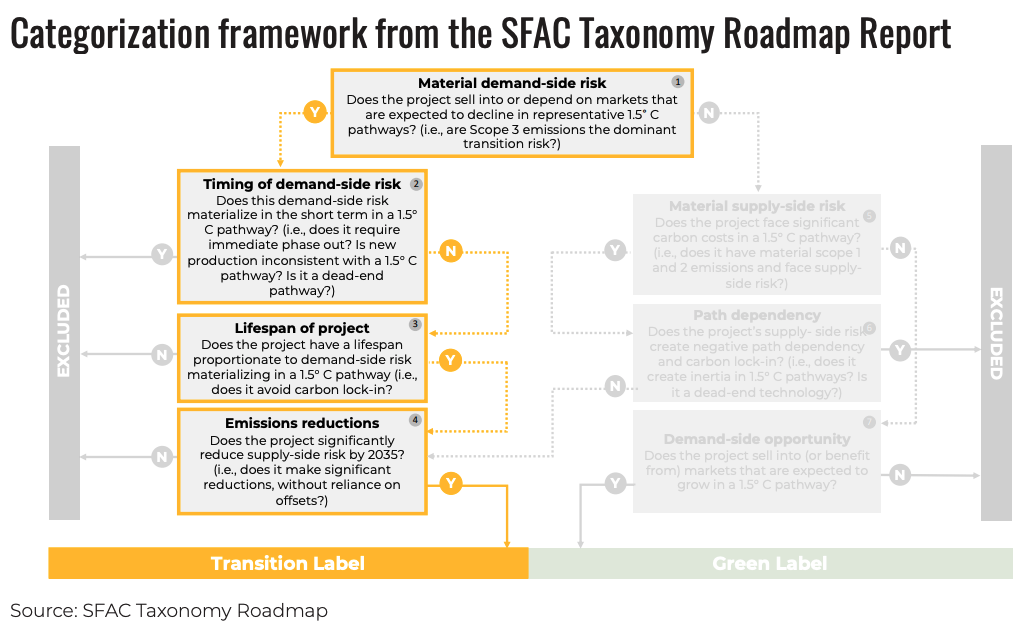

How should Canada fuel the transition of oil and gas projects in its taxonomy? We looked at the taxonomy framework proposed in the SFAC’s Taxonomy Roadmap Report, and developed an approach to categorize emissions-reducing oil and gas projects.

How can oil and gas projects fit in Canada’s Climate Investment Taxonomy?

A big part of the taxonomy framework developed by the Canadian Climate Institute is about defining “green” investments and projects. Almost all of the 30+ countries that have developed or are developing taxonomies focus on defining this green label. It typically includes activities and projects that are already aligned with a net zero future such as renewable electricity, batteries and storage, electric vehicles, and low-carbon hydrogen. For these types of projects SFAC recommends mirroring the frameworks and leading practices from elsewhere, such as the European Union.

Unlike other countries and regions, the taxonomy framework developed by the Canadian Climate Institute establishes a “transition” category. The role of this label is to identify, and unlock funding for, credible pathways to rapidly decarbonize Canada’s emissions-intensive sectors including oil and gas.

Why include oil and gas projects in a Climate Investment Taxonomy

Including any oil and gas activities in the taxonomy raises legitimate concerns about preserving the taxonomy’s credibility. Climate science is clear that the production and consumption of fossil fuels must decrease significantly and rapidly if the world is to keep global average temperature rise to below 1.5°C.

But it is exactly because of the oil and gas sector’s high emissions profile that it is essential to have a transition label that can evaluate oil and gas decarbonization projects. As global demand for fossil fuels starts to decrease this decade, large-scale investments to decarbonize the upstream production of oil and gas will be necessary to achieve Canada’s climate targets and maintain industry competitiveness.

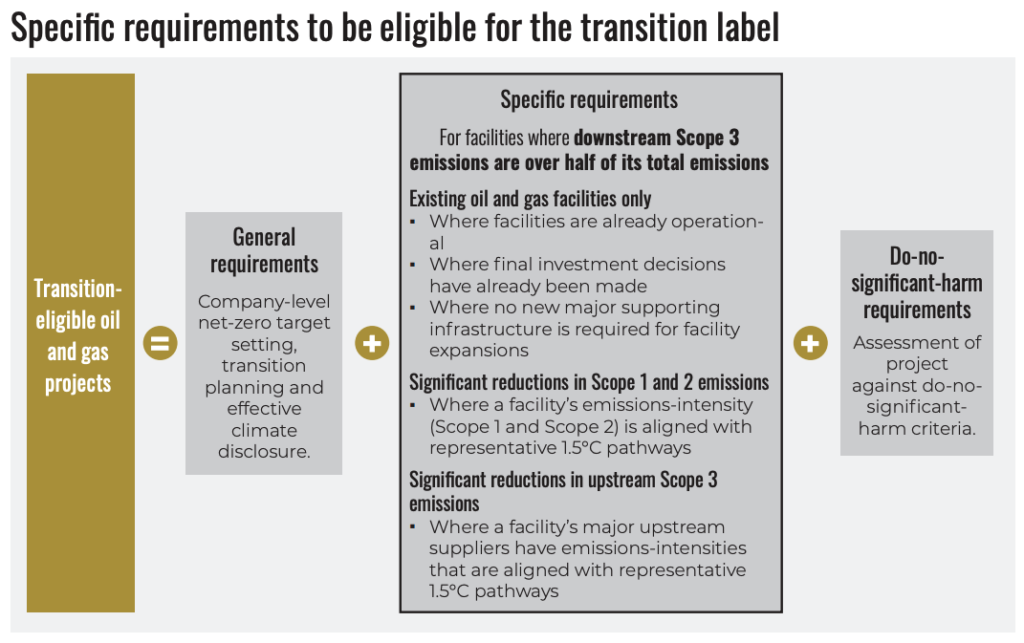

Figure 1 summarizes the specific requirements for projects to be eligible for the transition label category within SFAC’s taxonomy. Taken as a package, these requirements provide a credible path for determining which pollution-reducing projects in the oil and gas sector could qualify for the taxonomy’s transition label and therefore be eligible for preferential lending terms.

Categorizing oil and gas investments in the taxonomy

To determine whether existing oil and gas projects are eligible for the proposed transition label in SFAC’s taxonomy, we focused on three main questions:

- When are downstream Scope 3 emissions from a particular project considered the dominant transition risk?

- What is the definition of new vs. existing oil and gas facilities?

- How can the taxonomy determine whether project lifespans and emissions reductions align with 1.5°C pathways?

Fueling the transition outlines how these questions can be used to confirm which projects are eligible for the transition label. It details the strengths and challenges of this approach.

Overall, this paper suggests setting a high bar for what types of oil and gas projects could become eligible for the taxonomy’s transition label with a focus on keeping Canada on a pathway to meet its climate targets. Using detailed criteria and metrics, the transition label strikes a balance between promoting transformative investments and preventing carbon lock-in.

An effective and credible climate taxonomy must aim high and reach far. With the proposed transition label, Canada has a unique opportunity to become a global leader on Climate Investment Taxonomies. It is positioned to provide guidance to other countries on how a taxonomy can help to transition hard-to-abate sectors. It can also help position Canada’s economy to remain competitive in a low-carbon world.