The global energy transition is accelerating, with countries around the world pulling a range of policy levers to mobilize private investment. In this sink-or-swim moment, and particularly in the wake of the U.S. Inflation Reduction Act, Canada needs to develop its own strategy, and quickly.

But what is the best approach for Canada?

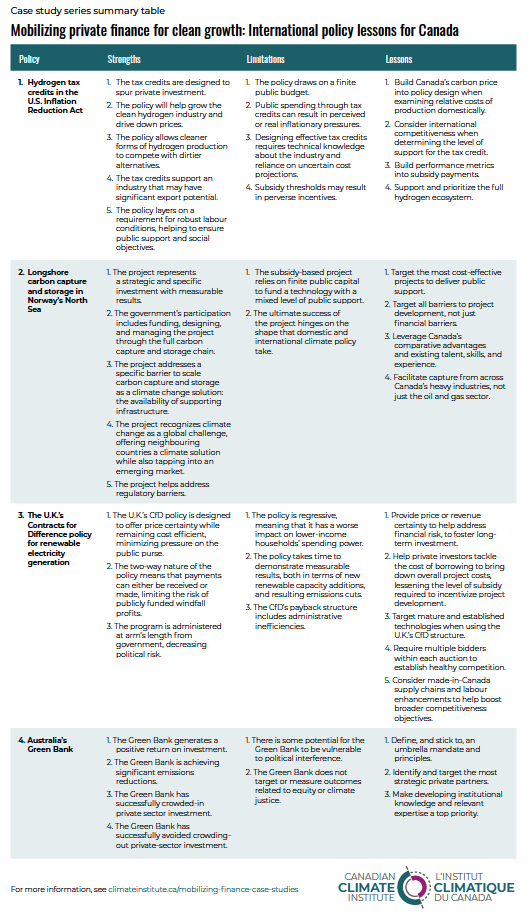

To help answer that question, we’ve assembled a series of international case studies that consider promising policy instruments from around the world. Each study assesses the strengths and limitations of a different policy instrument. Together, they suggest that a made-in-Canada strategy must capitalize on our strengths and introduce mechanisms to quickly mobilize capital investment in clean growth.

Case studies

UNITED STATES OF AMERICA

This case study describes hydrogen tax credits under the U.S. Inflation Reduction Act and examines their strengths and limitations, including in relation to their ability to spur private sector investment into climate solutions.

The design of the U.S. tax credits, offering incentives for both investment and production of clean hydrogen, differs from the design of the Canadian clean hydrogen tax credits proposed in Canada’s 2022 Fall Economic Statement. A better understanding of the U.S. model can help inform the option space as Canada moves forward on its clean hydrogen policy pathway.

NORWAY

Norway’s Longship project aims to capture carbon dioxide from heavy industries, including cement and waste combustion, and bury those captured emissions deep under the North Sea.

Some two thirds of the first phase of the project is being financed by the Norwegian government, and is due to come online in the next two years. The remaining funding is coming from private-sector partners from the oil and gas industry, who are also providing expertise in offshore drilling and carbon dioxide storage. Norway aims for the project to evolve to operate commercially (and profitably) in its later stages, tapping into a budding market for carbon capture and storage across Europe. The targeted financial support offered to this project is different to the broad-based investment tax credits being proposed in Canada to support carbon capture and storage. In Norway, the government designed and will partially operate the project, with the investment expected to yield initial results of 1.5 megatonnes of carbon dioxide captured per year. Longship is an example of a strategic investment that builds on existing skills, experience, and geographical advantages. It is also an example of the government placing its bets on climate action and carbon pricing accelerating domestically and regionally, thereby spurring market growth for carbon capture and storage services. The program therefore positions private industry to better foster the emerging opportunity while also strengthening a key climate change solution to industrial decarbonization.

UNITED KINGDOM

This case study describes the United Kingdom’s Contracts for Difference (CfD) policy for renewable electricity generation, examining the policy’s strengths and limitations, including its ability to offer revenue certainty to the private sector while minimizing costs to the public.

The U.K. essentially guarantees the price per kilowatt hour that project proponents can expect to receive over 15 years, offering a level of certainty that helps spur private sector investment. The U.K. has been successful in leveraging market competition to bring down public costs, and has established an independent body to administer the program. There are several applicable lessons from the design of the U.K.’s CfD policy that could usefully inform Canadian policy development, particularly as Canada examines the CfD financial model as a means to support low-carbon industrial decarbonization, including under its new Canada Growth Fund.

AUSTRALIA

With more than a decade of experience, the Clean Energy Finance Corporation (CEFC)—Australia’s Green Bank—has committed over C$10 billion in funding to a wide diversity of clean growth projects, with a mandate to accelerate clean energy and reduce emissions while generating a positive return on its investments.

As a publicly funded body, Australia’s Green Bank does not take the place of private-sector investment; instead, it looks for gaps in funding and is willing to take on additional risk or provide more flexible lending terms for eligible clean growth projects. As a result of its willingness to take on additional risk and act as a trusted partner, the bank has been successful in leveraging private-sector investment into renewable energy, energy efficiency, and low-emissions technologies, with investments demonstrating measurable impacts on emissions. The model offers several lessons learned that could be useful guidance for the Canada Infrastructure Bank and new C$15 billion Canada Growth Fund. These include ensuring a clear mandate and principles to guide investment decisions, leveraging private partnerships to maximize impact, and prioritizing in-house expertise to effectively steer the fund.

Summary

Related content