Introduction

The United States passed the Inflation Reduction Act in August 2022—landmark legislation that earmarked around $369 billion for energy security and climate change initiatives, including an unprecedented focus on clean hydrogen. The act introduced a clean hydrogen production tax credit and extended the existing investment tax credit to hydrogen projects and standalone hydrogen storage technology.

Tax credits have been broadly applied globally. They have the potential to mobilize private-sector capital into desired areas, essentially subsidizing a portion of the cost of goods or behaviours, and incentivizing their adoption. Here in Canada, examples of tax credits range from charitable donations by individuals to scientific research by businesses. Though the term tax credit can often be confused with a deduction in taxable income, refundable tax credits represent a direct payment, and like all subsidies, they are financed through the public purse.

Tax credits can make clean hydrogen production more attractive than alternatives, lowering investment costs or increasing return on investment. Tax credits can also be applied to strengthen hydrogen demand by subsidizing end-use applications such as heavy-duty hydrogen-powered vehicles.

This case study will examine a range of private and public policy implications from using tax credits, both domestically and internationally, including their impact on global competitiveness. The passage of the Inflation Reduction Act south of the border has led Canadian businesses to call for additional government support, arguing that projects and capital will flow to the jurisdiction offering the greatest economic advantage.

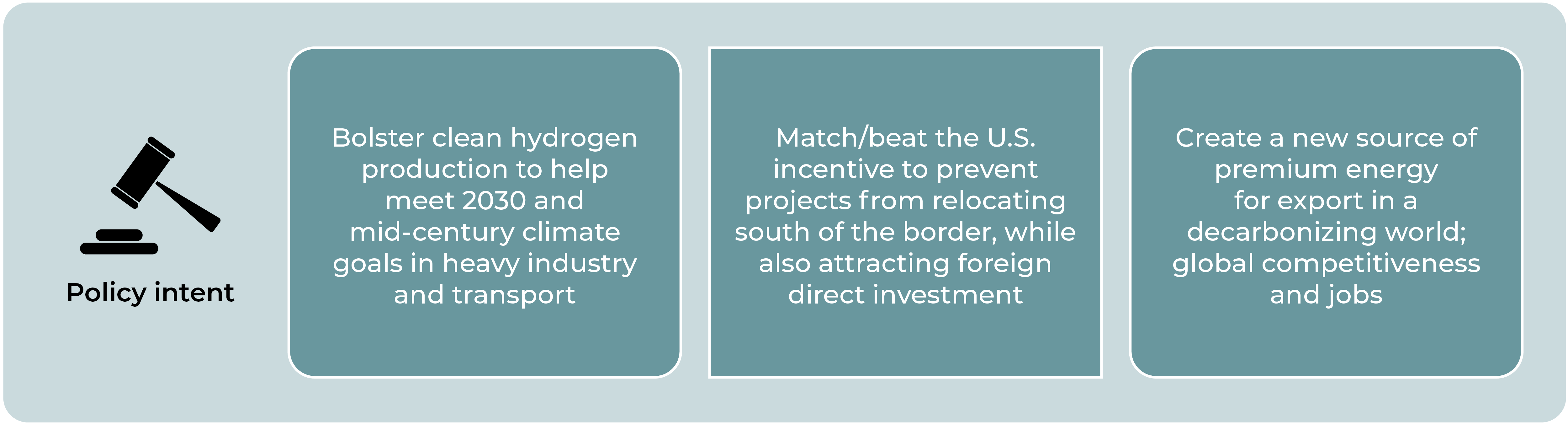

In the 2022 Fall Economic Statement, the Canadian government reconfirmed its Budget 2022 commitment to establish a clean hydrogen investment tax credit. The credit is set at a maximum of 40 per cent of project costs—an increase from the 30 per cent proposed in the previous spring budget—based on climate impacts and labour conditions. The intended policy outcome of the Canadian investment tax credit is likely to be threefold, as depicted in Figure 1.

Figure 1: Canada’s proposed hydrogen tax credits can achieve three policy aims

This case study takes a closer look at the U.S. hydrogen tax credits, and explores how their design may inform Canada’s support for hydrogen fuels in particular as well as its use of tax credit policy more broadly.

Description of the policy

The Inflation Reduction Act tax credits are available for clean hydrogen projects, where “clean” is defined as producing less than 4 kilograms (kg) of carbon dioxide equivalent (CO2e) per kilogram of hydrogen, measured on a life-cycle basis. For comparison purposes, emissions associated with “grey” hydrogen—the most common form of U.S. hydrogen production, produced with natural gas—range from around 10 to 12 kg of CO2e per kilogram.

The process-neutral design of the credits allows for many different types of technologies to be eligible, including electrolysis from renewable electricity to create “green” hydrogen, or steam methane reforming with carbon capture to create “blue” hydrogen, as both of their emissions intensities may be lower than the 4 kg cap.

The Inflation Reduction Act package included both an investment tax credit as well as a production tax credit, and will also support other parts of the hydrogen landscape through tax credits for clean energy and energy storage, as well as credits for fuel cell vehicles and alternative-fuel refuelling infrastructure.

Investment tax credit

The Inflation Reduction Act allows clean hydrogen production facilities to be included in the scope of the investment tax credit program for clean energy (Section 48 of the Act). Clean hydrogen project proponents may receive support equal to up to 30 per cent of their project costs, depending on the emissions intensity of their production process. A facility will receive a proportion of the maximum investment tax credit for the year that it is placed into service, depending on its emissions intensity, and wage and apprenticeship requirements. The amount of the credit is multiplied by five if certain wage and apprenticeship requirements are met.

Table 1: Lifecycle (“well to gate”) emissions, and share of project costs eligible for credit

| Kg CO2e per kg of clean hydrogen | Portion of project costs claimable as credit | Tax credit with wage and apprenticeship conditions |

|---|---|---|

| 2.5-4 | 1.2% | 6% of project costs |

| 1.5-2.5 | 1.5% | 7.5% of project costs |

| 0.45-1.5 | 2% | 10% of project costs |

| 0-0.45 | 6% | 30% of project costs |

The investment tax credit can also help companies access upfront capital, addressing a major barrier to project development, as banks and other investors will build the investment tax credit into lending decisions. Under the Act, hydrogen-related credits are also eligible for transfer to unrelated persons in a non-taxable cash sale.

Production tax credit

The Inflation Reduction Act’s new production tax credit—under section 45V of the Act—provides a payment over a 10-year period based on the amount of hydrogen produced. The value of the production tax credit varies depending on the clean hydrogen’s lifecycle greenhouse gas emissions intensity, with producers receiving a maximum of $3.00 per kg of hydrogen for the least emissions-intensive product, down to $0.60 per kg of hydrogen for the most emissions-intensive. The amounts depicted in Table 2 assume all wage and apprenticeship criteria have been met.

Table 2: Lifecycle (“well to gate”) emissions rate and resulting percentage eligible for credit

| Kg CO2e per kg of clean hydrogen | Portion of maximum tax credit | Tax credit |

|---|---|---|

| 2.5-4 | 20% | US$0.60/kilogram |

| 1.2-2.5 | 25% | US$0.75/kilogram |

| 0.45-1.5 | 33.4% | US$1.00/kilogram |

| 0-0.45 | 100% | US$3.00/kilogram |

Strengths and limitations of the policy

It is too early to say whether the U.S. tax credits will be successful in driving clean hydrogen production over more carbon-intensive methods. For this reason, this policy brief draws strengths and limitations of tax credit policy from broad-based economic theory, coupled with the U.S. experience with production tax credits for renewable energy more broadly. Production tax credits for renewables have been used successfully in the U.S. since they were first introduced under the Energy Policy Act of 1992. The production tax credit rate is currently 2.75 cents per kWh for wind, solar, geothermal, and closed-loop biomass power plants.

Strengths

- The tax credits are designed to spur private investment.

Tax credits lower the private costs of project development or operation, making these endeavours more financially attractive, and spurring interest from both domestic and foreign capital providers. Realizing the energy transition requires redirecting private-sector investment into areas of clean growth while attracting new sources of foreign investment that can supercharge economic growth more broadly.

- The policy will help grow the clean hydrogen industry and drive down prices.

New investment and private-sector interest can help the clean hydrogen industry scale, creating efficiencies and improvements that drive down prices. In the U.S., the cost of solar and wind generation has fallen dramatically as the industry has grown, with tax credits one of the drivers of economies of scale and efficiencies created through learning curves or experience curves. As a result of these realized efficiencies, both solar and wind are increasingly cost-competitive with dirtier forms of electricity generation, when measured across the lifecycle of the project.

- The policy allows cleaner forms of hydrogen production to compete with dirtier alternatives.

In the absence of subsidies, private actors will choose the cheapest way to produce and deliver hydrogen, and in the case of hydrogen production in the U.S., this is usually fossil gas. The clean hydrogen tax credits are designed to redirect the market to cleaner forms of production. Investment tax credits encourage private actors to take on investment risk for clean hydrogen projects, while production tax credits provide an additional return on investment beyond market prices. This allows clean hydrogen to compete with dirtier alternatives, bolstering a clean fuel needed for deep decarbonization, and attracting growth and jobs into the clean-energy industry.

- The tax credits support an industry that may have significant export potential

Hydrogen provides a global export opportunity, where clean hydrogen-based fuel is expected to be in high-demand in a decarbonizing world. Preparing domestic industries to meet this demand is smart, forward-looking industrial strategy. It prepares domestic industry for the global energy transition ahead, and helps provide additional supply of a clean fuel that is needed to tackle the climate crisis.

- The policy layers on a requirement for robust labour conditions, helping to ensure public support and social objectives.

The U.S. couples its clean-hydrogen tax-credit eligibility requirements with wage and apprenticeship criteria, allowing the stimulus to create good jobs and skill development. These rules include paying specific workers a prevailing wage and employing a certain number of registered apprentices. This provision helps ensure social equity objectives by promoting higher local standards for pay, training, and job quality. It also helps ensure ongoing public support for the policy since both the business and its workers can see direct benefits.

Limitations

- The policy draws on a finite public budget.

Subsidy-based policies fund private-sector activity through public dollars, where there is an opportunity cost to those dollars, such as foregone health care expenditures. Expenditures may be pitted publicly against shorter term needs. In addition, governments making a big bet on a technology can be risky, in terms of whether it will be able to scale, compete globally, or fully deliver a low-carbon climate solution. In addition, while the point of tax credits is to spur greater uptake, the cost of the policy will rise as deployment/use increases. As a result, capping or limiting the overall expenditure (or foregone revenue) of the tax credit policy may be needed to ensure accurate budget foresight.

- Public spending through tax credits can result in perceived or real inflationary pressures.

Canada’s inflation rate was 6.8 per cent in November 2022, down from the 39-year high of 8.1 per cent in June 2022, but far above the Bank of Canada’s 1-3 per cent target. This macroeconomic context means policy interventions must be designed carefully. Additional government spending can be inflationary, or can be perceived to be inflationary. Significant political opposition, citing concerns of inflation, forced the U.S. to ensure that the Inflation Reduction Act was fully funded—something made possible through spending cuts in other areas, but mostly through implementing targeted tax increases on highly profitable corporations. Of course, government spending can be non-inflationary if it bolsters productivity or relieves supply constraints in energy and labour markets, conditions that need careful consideration in tax credit policy design.

- Designing effective tax credits requires technical knowledge about the industry and reliance on uncertain cost projections.

Technical insight is required in order to choose the right levels of subsidy support and eligibility requirements: a tax credit that is too generous is susceptible to free-riding, where investors would have been willing to make the investment at a much lower incentive rate. But the amount must be high enough to make the investment in clean hydrogen cost-competitive with dirtier forms of hydrogen production or alternative energy solutions. This requires knowledge not only about technology and other project costs today, but also robust projections on how these costs are likely to change in the future. Governments are often advised to avoid policies that require a great deal of knowledge about a particular industry or technology, or otherwise may need to lean heavily on specialized consultants. Even the most skilled experts will make estimates that are riddled with uncertainty, as future circumstances, such as the price of other energy options, are bound to change.

- Subsidy thresholds may result in perverse incentives.

The U.S. tax credits are the most generous to hydrogen production that emits 4 kg of CO2e/kg or less, but this cap could stifle innovation to produce even cleaner hydrogen, since there is no incentive to go beyond that threshold. The more prescriptive the requirements for tax credit eligibility, the greater the opportunities for unintended consequences, with economic theory finding non-specific subsidies to be less distortionary. It should also be noted that costs of producing hydrogen will vary significantly depending on the jurisdiction across Canada, making regional winners likely to emerge under a blanket incentive scheme.

Lessons for Canada

The hydrogen sector is ripe for a global demand boom, with several regions jockeying for a greater share of global production. By 2050, hydrogen could represent as much as 10 per cent of global total final energy consumption, according to International Energy Agency estimates.

Canada is naturally positioned to compete in the international market for clean hydrogen, with a comparative advantage in abundant hydro resources, making clean power for electrolysis easy to come by, and providing a greater potential for green hydrogen to be produced at scale. Canada also has well-established expertise in linked areas, such as fuel cell production and carbon capture and storage. Any application of lessons from U.S. tax credit policy must therefore consider these Canadian-specific circumstances.

- Build Canada’s carbon price into policy design when examining relative costs of production domestically.

In order for clean hydrogen to compete domestically, it must become cost competitive with dirtier forms of production. The largest component of the costs associated with green hydrogen is the cost of renewable electricity, whereas the largest component of the costs associated with grey hydrogen is the cost of natural gas. In the U.S. the policy landscape only addresses the costs of green hydrogen, with tax credits bringing down project costs or offering a greater return on production. But in Canada, there is also a carbon price applied to fossil gas that is pushing in the opposite direction, pulling up the costs associated with grey hydrogen and changing the relative attractiveness of that option. In contrast to the U.S., where there is no price on pollution at the federal level, tax credit design in Canada will need to consider relative cost differentials with this carbon price included.

Effectively, Canada’s carbon price reduces the size of the tax credit required to effectively incentivize the desired action, pointing to a key difference between the U.S. and Canadian context that must inform domestic policy.

- Consider international competitiveness when determining the level of support for the tax credit.

There is no assurance that green hydrogen will be favoured over dirtier forms of the fuel internationally, and much of Canada’s green hydrogen export success will hinge on the climate ambitions of export markets. A tax credit designed to make green hydrogen more attractive than alternatives domestically, may be insufficient to see Canadian green hydrogen compete with alternatives internationally. Increasing the level of the green hydrogen tax credit to try to compete with dirtier forms of the fuel produced in international markets may not be efficient or practical. In addition, transport costs of the fuel to foreign markets become increasingly important. As a result, Canada will need to carefully consider its foreign market opportunities, targeting those regions likely to implement policies that favour the cleaner form of the fuel, such as the European Union, where it may better leverage its comparative advantage in clean electricity.

- Build performance metrics into subsidy payments.

Production tax credits have been viewed by economists as more efficient than investment tax credits, particularly when it comes to clean technology and energy, because production tax credits are more closely aligned to the final policy objectives—in this case, the production of clean hydrogen. Investment tax credits that are levelled purely against project costs risk spending public dollars inefficiently, as not all projects are successful, and costs can vary widely for the same outcome. While a generous 40 per cent investment tax credit looks set to move forward in Canada, it will be important to tie this incentive to final performance: the amount of clean hydrogen produced, and potentially other metrics related to nurturing the clean hydrogen ecosystem, such as regional training and development.

- Support and prioritize the full hydrogen ecosystem.

The U.S. looks set to target all three barriers to clean hydrogen growth: high-risk investments, high production costs, and a lack of infrastructure to support demand (for example, storage and transportation). In addition to the clean hydrogen investment tax credit and production tax credit, the U.S. Bipartisan Infrastructure Act, passed in November 2021, included US$1 billion for electrolysis research, US$0.5 billion for research and development of clean hydrogen manufacturing and recycling, and US$8 billion for regional clean hydrogen hubs. In Canada, continued support for research, development, and demonstration is likely needed, given that clean hydrogen has not yet achieved full technology maturity. And additional policies can help drive domestic demand for clean hydrogen, such as programs supporting clean hydrogen for heavy-duty vehicles and related infrastructure.

Conclusion

Tax credits have the potential to spur private-sector investment, including foreign direct investment, supporting Canada’s economic growth. Applying these credits to clean hydrogen can help build and strengthen the sector, supporting efficiencies through economies of scale, and helping provide a fuel that is expected to be required to meet Canada’s climate targets. Tax credits can also bolster the export potential of a clean fuel that may be increasingly in demand in a decarbonizing world. However, the cost of the policy to the public purse must be carefully considered, and technical expertise may be needed to ensure that the incentive is set at the right level to avoid free-riding behaviour. Canada may need to depend on the climate ambitions of its partners to see the clean hydrogen export market bloom. At the same time, Canada will need to build out its domestic market by supporting clean hydrogen end-use applications and transport infrastructure, and creating other conditions for a successful industry, including a rising price on carbon.