Introduction

The United Kingdom’s Contracts for Difference (CfD) is a publicly funded support measure for large-scale renewable energy projects, introduced in 2014. The CfD policy targets clean electricity investment—to date, mainly offshore wind—and is designed to protect project proponents from changes to the wholesale electricity price.

Canada, through its new Growth Fund, has recognized CfD policies as an effective way to provide the private sector with price or revenue certainty. Canada has also considered ways to better guarantee its carbon price schedule through carbon contracts for difference (CCfD), a policy that would be similar to the UK’s CfD but offers certainty around the price of carbon, rather than the price of electricity.

In effect, the U.K. CfD policy closes the gap between the price that a clean electricity generator needs to receive in order for the business investment to be attractive, and the price provided through supply-and-demand dynamics on the fluctuating power market. The CfD therefore provides a guarantee of a steady revenue stream, addressing private-sector investment risk and making for a more appealing investment environment compared to other forms of energy.

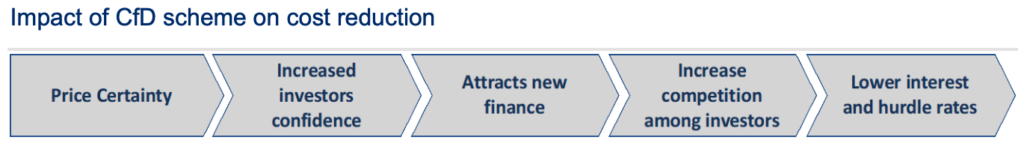

The certainty provided by the CfD also allows project developers to borrow money at lower interest rates, attracting new entrants that increase competition and help drive down costs. This attractive investment landscape, coupled with technology advancements and economies of scale, has seen the public cost of the U.K.’s CfD on a per-kilowatt basis fall significantly over the years.

Figure 1: The U.K.’s CfD reduces costs to the public by providing price certainty to the private sector.

As a subsidy-based policy, the U.K.’s CfD has a unique financing structure in that it is ultimately paid for by U.K. power consumers—though one of its longer-term objectives is to stabilize consumer electricity rates. The CfD payments are funded by a statutory levy on all licensed electricity suppliers, with this cost eventually passed on to households and businesses through their power bills.

The private market intervention has been justified by policymakers through three channels: greenhouse gas emissions reductions, energy security, and long-term energy affordability. On the first, the U.K. is striving towards a mid-century net zero greenhouse gas emissions target, pledging to decarbonize the electricity grid by 2035 from the current over-40-per-cent fossil fuel-based portfolio.

Meanwhile, Europe’s current energy crisis has brought energy security and affordability to the forefront of policy decision making. While some observers have called for quick-fix fossil-fuel production increases, successive heads of U.K. government have noted that renewable energy will ensure less exposure to volatile fossil fuel prices set by international markets.

The U.K.’s independent Climate Change Committee, the official advisor to the government, has estimated that reaching the net zero commitment will require an investment of £50 billion (C$81 billion) a year by 2030, with much of this investment needed to replace older energy-related infrastructure. The U.K. government has said that it aims to leverage £90 billion (C$146 billion) of this amount from private actors through 2030.

With these objectives clearly defined, the U.K. government hit the accelerator on the CfD policy in February 2022, committing to annual auctions from March 2023 rather than the previous biennial schedule, with the aim of more rapidly spurring private capital towards quicker renewable energy deployment.

Description of the policy

All power generators sell their electricity on the open market in the U.K., or sometimes through a power purchase agreement. The market price fluctuates with supply-and-demand dynamics, where the price received is determined by the cost of supplying the last unit of electricity. In the U.K., it is the marginal cost of fossil gas-powered generation that currently sets the wholesale price across the market. Since the price of fossil gas is determined on the international market, power prices can vary significantly, and are currently very high due to the region’s geopolitical instability.

The CfD is designed to fill the gap between this wholesale market price and the generator’s strike price. The strike price is determined through the auction process and, once set, will not fluctuate throughout the life of the contract, currently 15 years. Generators will consistently receive the strike price for each unit of electricity produced.

Within the auction process, renewable generators submit a sealed bid that represents the price they desire to be paid per kilowatt hour to make the project profitable. An administrative maximum strike price is set by the U.K.’s Department for Business, Energy and Industrial Strategy, the entity responsible for the policy. The U.K.’s system operator, the National Grid, runs the auctions and ranks the bids by unit price. It then accepts the best bids up to the point where the budget or capacity caps are reached. The sealed bid for the last project accepted sets the strike price that all successful bidders receive, so long as they are in the same year/technology “pot.” While the strike price applies to the full 15 years of the contract, it is indexed for inflation, with annual adjustments.

While the policy is run by the Business, Energy and Industrial Strategy department, the contracts themselves are administered by the Low Carbon Contracts Company, a government-owned private company. The Low Carbon Contracts Company is also tasked with recouping the cost of the program through a levy set on power suppliers—that is, those delivering final electricity requirements to end-use consumers.

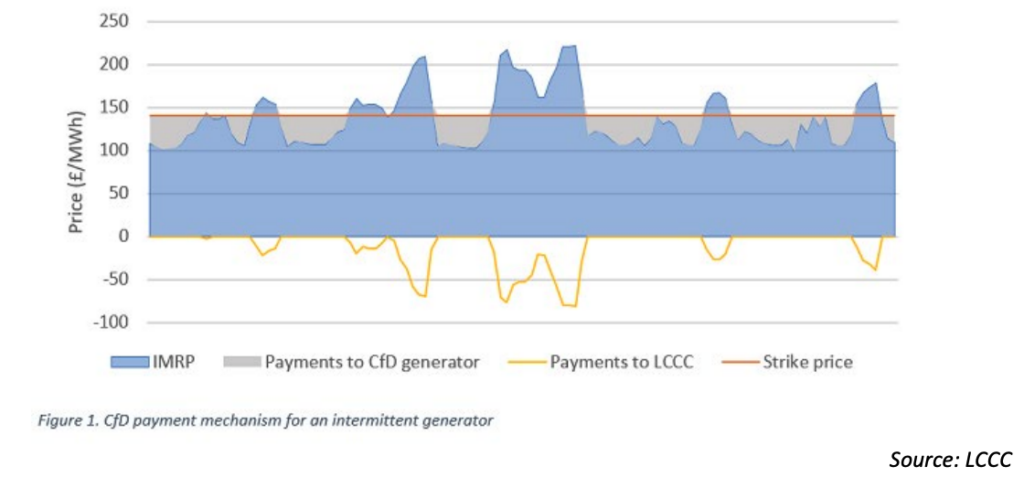

An important design detail for the CfD is that payments are run on a two-way street. If the average wholesale price (the “reference price”) is below the strike price, the Low Carbon Contracts Company pays the generator the difference. But when the strike price is below the reference price, the generator pays the Low Carbon Contracts Company the difference (Figure 2).

Up until recently, the reference price had been consistently below the strike price of projects, and the Low Carbon Contracts Company had been directing difference payments to generators. However, with the onset of the European Union’s energy crisis and related sky-high fossil gas prices, the wholesale electricity price has been above the strike price, meaning that generators have made payments back to the Low Carbon Contracts Company.

Figure 2: Under a two-way CfD, firms make or receive support payments depending on market price

The CfD continues to garner considerable interest from the private sector, with investment pouring into the market. Results from the policy’s fourth allocation round were published in July 2022, confirming 93 new projects, more than in the previous three auctions combined, and bringing the total number of CfDs under management to 168. The allocation round is expected to result in nearly 11 gigawatts of additional generating capacity, with these sourced from offshore wind, onshore wind, solar, remote island wind, and—for the first time ever—tidal stream and floating offshore wind. When those projects are all in operation, CfD-combined projects will provide around 30 per cent of the U.K.’s power needs. The fifth allocation round that is due to open for bids in March 2023 will push this figure upwards.

Policy strengths and limitations

As a result of the significant additions to renewable energy capacity to date, and innovative auction-based design, the U.K. CfD is broadly recognized as a policy success story. The policy has several strengths relative to its predecessor, the Renewables Obligation system, which placed a requirement on suppliers to source an increasing proportion of electricity from renewable sources, similar to a renewable portfolio standard. Since the Renewables Obligation system could have achieved the same renewable capacity result as the CfD, it is worth considering the specific characteristics that have made the U.K.’s CfD policy world-renowned, while it is also important to note its limitations.

Strengths

- The U.K.’s CfD policy is designed to offer price certainty while remaining cost efficient, minimizing pressure on the public purse.

Subsidy-based programs are often criticized for inefficiencies, including when publicly funded payments are higher than what would be required to spur private action, resulting in freeriding. Freeriding can be a problem because incremental public payments do not result in incremental investment. The policy has weakened these types of occurrences through the competitive nature of its auctions, which have been able to leverage competition and capture the falling costs of renewable technologies.

Reflecting the falling costs of renewable technologies, costs per kilowatt hour have fallen successively each CfD round, and by a massive 65-75 per cent since the first auctions were held in 2015.

As only the lowest price bids are successful, private actors will compete against each other, finding innovative ways to drive down costs, and ultimately bringing down the cost of the policy on ratepayers.

- The two-way nature of the policy means that payments can either be received or made, limiting the risk of publicly funded windfall profits.

The two-way design characteristic, which sees generators pay into the program when the wholesale price of electricity is high, has been particularly important for cost efficiency as well as for garnering public support. Since September 2021, record-breaking energy prices have seen low-carbon generators under the CfD scheme make payments back that reflect revenues received in excess of the agreed strike price. Since the design of the CfD largely prevents participants from reaping windfall profits at times of high wholesale energy prices, they have been exempted from the 45 per cent windfall profit tax that the U.K. will levy on other energy providers between January 2023 and March 2028. This has also meant cost savings for ratepayers, with over £1 billion (C$1.66 billion) in revenues from generator payments expected to be received between April 2022 and March 2023.

- The program is administered at arm’s length from government, decreasing political risk.

Ensuring the CfD is administered through a private organization protects the integrity of the program from political fluctuations. Successful renewable project proponents enter into a private law contract with the Low Carbon Contracts Company, which issues the contracts, manages them during the construction and delivery phases, and issues CfD payments. The government is the sole shareholder of the Low Carbon Contracts Company and therefore is represented on the board, and requires certain types of reporting to the Department for Business, Energy and Industrial Strategy. But the CfD is designed as a private-law contract, in which the Low Carbon Contracts Company is the counterparty, and cannot be cancelled without legal repercussions. This protects the policy from political interference or cancellation, promoting investor confidence.

Limitations

- The policy is regressive, meaning that it has a worse impact on lower-income households’ spending power.

Given that the CfD policy is paid for through a per-unit levy on end users, the more electricity consumed, the higher one’s payments towards the scheme. Although the amount of power consumed normally increases with income—making overall payments to the program larger for higher-income earners—lower-income earners generally pay a higher proportion of their available income towards energy costs, making the policy regressive. For this reason, complementary policies are advisable to lessen the disproportionate burden of the levy on lower-income earners. The U.K.’s Warm Home Discount Scheme, fuel vouchers, and Cold Weather Payments are all examples of complementary policies offering this type of targeted support.

- The policy takes time to demonstrate measurable results, both in terms of new renewable capacity additions, and resulting emissions cuts.

Although all policies take time to show results, the U.K. experience clearly demonstrates the delay between policy implementation and the time it takes for renewable power objectives to materialize. Contracts awarded in October 2019 will see committed capacity come fully online only by 2027, though there will be a gradual ramp-up to this capacity onwards from 2024. Private-sector industrial investment decisions can take years to develop, and the price certainty offered by the CfD is needed before most projects can access capital and begin due diligence and other approval processes. Measurable emissions reductions follow many years later.

- The CfD’s payback structure includes administrative inefficiencies.

Since September 2021, wholesale power prices have exceeded CfD strike prices, requiring generators to make payments back to the Low Carbon Contracts Company. This has meant that the levy on suppliers has been set to zero because the regulations do not allow the Low Carbon Contracts Company to set a negative levy rate. Instead, the reverse flows happen at quarterly reconciliation points where the Low Carbon Contracts Company pays the accumulated sum of the payments to suppliers. The challenge is that these quarterly payments are not translated in the same way into reduced payments for consumers. It is left to suppliers to determine how the Low Carbon Contracts Company payments are used, and it is not clear to what extent the payments help mitigate higher power bills. That is the cost-saving pass-through rate is not always known.

Lessons for Canada

Generally speaking, CfD policy can be applied to other climate change mitigation technologies under consideration in Canada, such as carbon capture and storage and clean hydrogen production. There are, therefore, several applicable lessons from the CfD policy that may be beneficial to Canadian policy development, particularly as Canada examines the CfD financial model to support industrial decarbonization, including under its new Canada Growth Fund.

- Provide price or revenue certainty to help address financial risk, to foster long-term investment.

CfD is able to spur private investment through risk management, including by providing certainty about a project’s revenues. The U.K.’s CfD policy also pushes the administration of the contracts to a private company, the Low Carbon Contracts Company, sheltering the policy from inconsistencies in political support and risks of program rollback. The Low Carbon Contracts Company could serve as an important model for administering Canada’s $15 billion Growth Fund. The fund—slated to be launched by the end of this year—has promised to include a “permanent and independent” structure, which is to be defined by the first half of 2023. Although further details are not yet known, the government has been clear that the growth fund will transition from a subsidiary under the Canada Development Investment Corporation to an institution with operational independence.

- Help private investors tackle the cost of borrowing to bring down overall project costs, lessening he level of subsidy required to incentivize project development.

The cost of capital can be a significant portion of project costs and an indicator of whether a project will go ahead, with these costs generally increasing with the risk profile of the project. The certainty provided by the CfD makes a project more attractive to investors, lowering interest rates and thereby overall project costs for project developers. Beyond assurance of a solid and long-lasting program, this requires sophistication in lending institutions, and government programs could be developed to ensure capacity to correctly identify the risk mitigation effects of the policy.

- Target mature and established technologies when using the U.K.’s CfD structure.

The CfD policy was applied in the U.K. after renewable power, specifically offshore wind, was well advanced. To get to that point, government policies focused earlier on research-and-development investment and supply chain growth. CfD policies may be more suitable to scale technologies that have already proven themselves, rather than early-stage innovations.

- Require multiple bidders within each auction to establish healthy competition.

As a result of its auction-based design, the U.K.’s CfD has been successful in driving down costs compared to other forms of subsidies. Private actors are incentivized to find cheaper ways to generate clean electricity in order to win the contracts, driving down costs. However, in order for auctions to be successful, there needs to be many private actors involved, and these actors should not have means to collude on price bids. A strong pipeline of projects and cohort of developers is needed for the auction model to be successful.

- Consider made-in-Canada supply chains and labour enhancements to help boost broader competitiveness objectives.

The low-carbon transition is set to present a significant economic opportunity, but global competition is likely to be intense. Many countries are taking a strategic approach to their industry support policies. The U.K. has recently made locally sourced content requirements a part of CfD eligibility for turbines, something that Canada might consider when examining supply-chain requirements. Other related provisions include building domestic talent through employment strategies that are tied to the policy’s support structure.

Conclusions

The U.K.’s CfD has proven to be a policy success story, spurring additional renewable capacity, leveraging private-sector investment, and both driving and benefiting from falling technology costs. The transferability of this success to the Canadian context, however, will depend on several factors. Primarily, the U.K. CfD model is best suited to mature technologies with robust market competition, to ensure successful auctions. The price guarantee must then be delivered over a long-time horizon, such as 15 years, with a suitable administrative institution that is not vulnerable to political fluctuations.