Hydrogen optimism is back, after a bit of a hiatus. Hydrogen related company stocks are on the rise, truck manufacturers are investing, fuel cell costs have declined by 60 per cent since 2006, and energy experts are weighing in (see here and here). The context has also changed. Over 77 countries, including Canada, have committed to net-zero targets, and credible plans to meet those targets must consider all options.

But what is hydrogen fuel? Where does it come from? Where are the opportunities for deep emission reductions in Canada? And what does that all mean for policymakers? This blog unpacks these questions—and raises a few more.

Hydrogen 101

Hydrogen is a so-called “energy carrier”, meaning it stores energy and can be delivered from where it’s produced to where it is used. It can be used to generate heat for buildings and industries, to generate electricity in fuel cells, to store energy for intermittent renewables like solar when the sun isn’t shining, and to produce other products such as gasoline, fertilizers or biofuels.

How is hydrogen produced ?

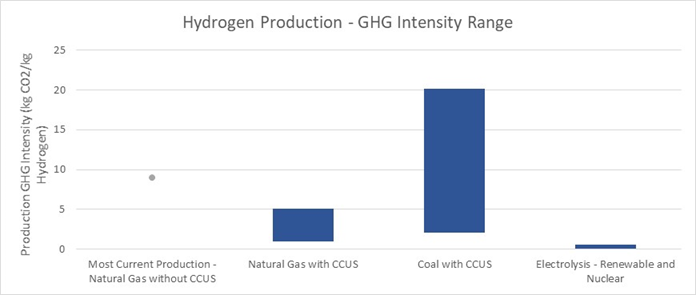

There’s more than one way to make hydrogen. But how it’s produced has big implications for the extent to which it can reduce greenhouse gas emissions.

Currently, most hydrogen is produced from fossil fuels such as natural gas without carbon capture utilization and storage (CCUS), often cited as grey hydrogen. This approach has relatively high GHG emissions, so is not a path to significant GHG reductions.

Several options to produce lower carbon intensity hydrogen exist, including using fossil fuels with CCUS (blue hydrogen), or even extracted from oil reservoirs as Proton Technologies is planning to do in Saskatchewan, or with electrolysis using renewable or nuclear energy (green hydrogen when from renewable sources). Hydrogen produced with fossil fuels would still produce greenhouse gas emissions, since not all emissions can be captured.

Figure 1: GHG intensity of different hydrogen production options (Source: IEA and Innovation Energy Laboratories)

How can we use hydrogen?

Hydrogen is versatile. It can be used to produce heat, electricity via electrolysis, as a building block for industrial processes feedstock, as energy storage and as export commodity.

- Industrial process: Hydrogen is already used in industrial processes such as the petrochemical sector, producing it in a cleaner way would reduce emissions from these sources. Shell’s Quest project in Alberta is already reducing on average 1 MTCO2eq/year, producing cleaner hydrogen to upgrade bitumen.

- Transportation: Hydrogen can be used to power cars, trucks, trains and many other transport options via fuel cells. In Canada, Emissions Reduction Alberta is funding a $15 million hydrogen freight truck demonstration, and Ballard is building hydrogen fuel cells for trains in Germany and other markets .

- Residential and commercial heat: Hydrogen can also be injected directly into the natural gas network reducing emissions from every building that uses natural gas heating. Enbridge, for example, is already using surplus electricity to produce hydrogen that is either stored for later conversion to electricity or injected into the natural gas network.

- Export: There is also the potential for hydrogen exports, which could further reduce emissions globally. Western Canada may have a comparative advantage in producing low-carbon hydrogen that could supply growing international demand. Japan for example aims to increase hydrogen imports to help meet its climate targets.

- Energy Storage: Hydrogen can also facilitate other low-carbon technologies such as renewable energy. Wind, solar and run-of river hydro technologies are all intermittent. Hydrogen offers a unique combination of large scale and long-term energy storage and is a competitive option for long-term storage according to the IEA.

- Industrial Energy Use: Industries across Canada require heat, primarily from fossil fuels, to produce oil and gas, steel and cement and manufacture products. Low-carbon industrial heating options have proved difficult to develop and deploy, but hydrogen could fill this role displacing natural gas and coal. Ovako, a European steel manufacturer, is experimenting with replacing natural gas with hydrogen at its Hofos steel mill.

What are the barriers to this opportunity?

So if hydrogen is so great, why isn’t it already being used? Cost and infrastructure are the two main barriers.

- Cost

The number one barrier is the cost of producing, distributing and in some cases, like transport, the technologies to use hydrogen. In the near-term low-carbon hydrogen appears most competitive when used as part of industrial processes (a feedstock), since in many instances it can be produced on-site, has few alternatives and the process is amenable to carbon capture and storage if storage is available (Figure 2).

Figure 2: Industrial hydrogen cost with and without CCUS

In the transport sector freight is the main opportunity. Although not competitive today, cost declines could make this the cheapest path to low-carbon freight (Figures 3 and 4).

Figure 3: Current and future passenger vehicle lifecycle cost range for different low-carbon technologies

Figure 4: Current and future freight truck lifecycle cost range for different low-carbon technologies

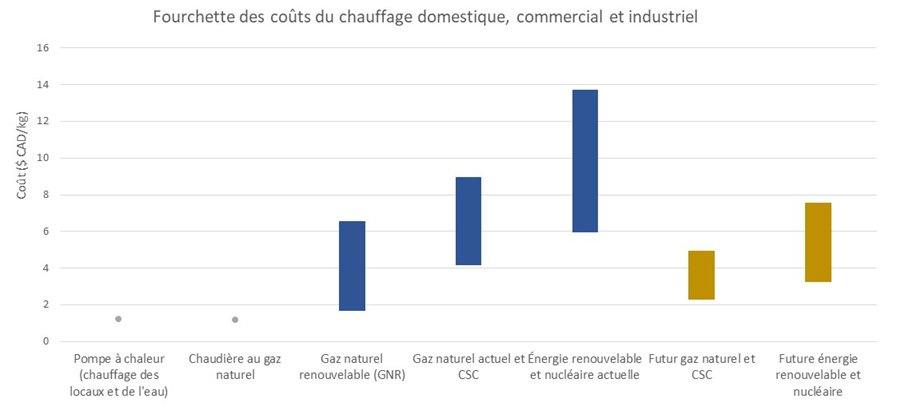

Hydrogen remains a high cost alternative for home heating and industrial heat in Canada. Even with significant cost declines, hydrogen remains four times more expensive than both natural gas and heat pumps for space and water heating, powered by non-emitting electricity sources (Figure 5).

Figure 5: Home, business, and industrial heat cost range comparison for various heating technologies

(Sources for all graphs – International Energy Agency (2019) The Future of Hydrogen, RNG costs from Canadian Gas Association (2014) Renewable Natural Gas Roadmap for Canada.)

In all cases there are reasons to be optimistic. Hydrogen production and use benefit from ongoing cost declines in wind, solar and lithium batteries since hydrogen can be produced using solar and wind, and fuel cell vehicles use batteries. Like wind, solar and batteries, hydrogen production and fuel cell technologies are poised for significant cost declines from economies of scale and learning by doing. All told, the IEA estimates fuel cells costs could decline by 75 per cent and delivered hydrogen (both production and distribution) by 45 per cent.

- Infrastructure

Today most hydrogen is produced and used onsite, such as at petrochemical facilities or transported via trucks, but neither of these options are sufficient for widescale hydrogen use. Transporting hydrogen by pipeline, either blended with natural gas or in dedicated infrastructure are both possible and done in Canada today. However, blending hydrogen into natural gas networks is technically limited to 17 to 25 per cent by volume in local distribution systems and 5 per cent by volume in transport pipelines. Even when the pipelines are compatible, some end uses like natural gas turbines, compressors, storage tanks and some monitoring equipment are currently incompatible with higher than 1 per cent blends by volume. Still, the natural gas network and end uses need not be retrofitted all at once. Natural gas utilities can “island” portions of their grid that are designed to be compatible with higher blends.

It’s elemental

Hydrogen is rightfully receiving renewed attention as a solution to reducing emissions. Costs have declined, the search for low-carbon solutions has intensified and the future potential of hydrogen looks bright. Yet real barriers remain, and wide scale adoption is still a future prospect rather than a current reality.

In the short-term CCUS can reduce GHG emissions from hydrogen used as a feedstock at industrial facilities with local storage options, such as oil and gas facilities in Alberta. To play a larger role, costs must decrease further, producers must gain access to pipelines, and hydrogen must be produced with CCUS with high capture rates (blue hydrogen) and/or via electrolysis powered by renewable or nuclear electricity.

These are not easy challenges to overcome and that raises big questions moving forward. What are the policy options for overcoming those barriers? To what extent do the benefits of overcoming those barriers exceed the costs? And what role can blue hydrogen play in supporting Canada’s net-zero ambitions?

Canada will need answers to these questions, and soon, to inform its post- COVID-19 stimulus plans, to support its net-zero ambitions and to position itself in an emerging global industry.