The Russian invasion of Ukraine has upended markets for key commodities, particularly the critical minerals necessary for the global transition to a low-carbon economy. This latest shock, on top of rising prices for many critical minerals throughout 2021, could put the global push toward net zero in jeopardy.

Canada has an outsized role to play in ensuring that doesn’t happen. But to become a global leader in critical minerals, Canada needs to get a couple of key things right: prioritizing Indigenous partnerships while removing barriers to private finance.

What’s so critical about critical transition minerals?

Critical transition minerals refer to a small number of key commodities that are essential to producing the technologies and materials that will power a net zero economy. Lithium, for example, is essential for making electric vehicle batteries. Tellurium is necessary for solar panel production. And platinum is the ideal catalyst for hydrogen fuel cells.

As the International Energy Agency explains, demand for critical minerals will rise significantly as the net zero transition accelerates. A typical electric vehicle, for example, requires six times more mineral inputs than a conventional car. An onshore wind plant needs nine times more mineral resources than a gas-fired power plant.

Russia’s invasion of Ukraine has accelerated the crunch for both the global supply of and demand for these minerals. Prices surged to record highs in March 2022 on fears of supply disruptions to Russia’s vast reserves. Demand has also surged, with many European nations rushing to pivot to low-carbon alternatives to Russian oil and gas.

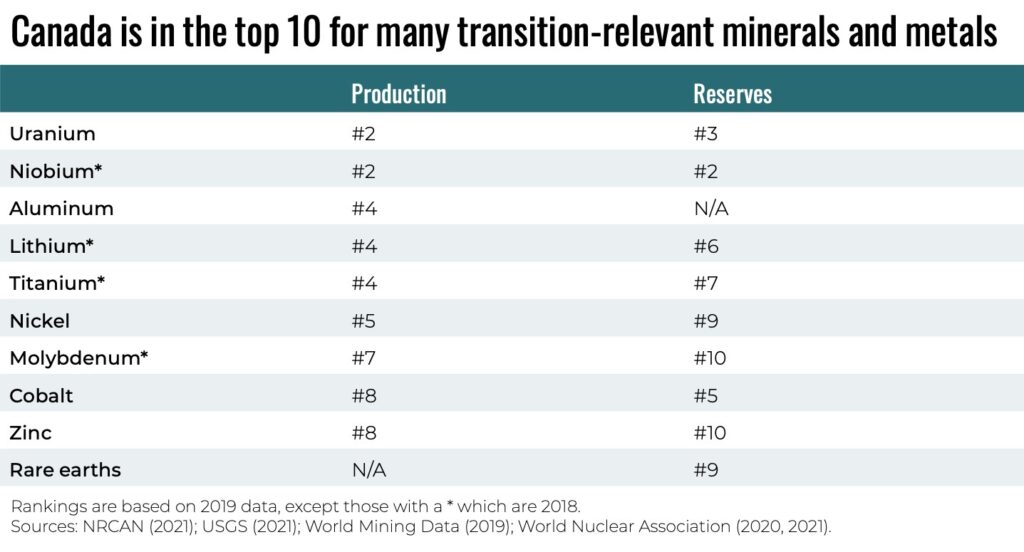

Fortunately, Canada is standing ready with vast experience in mining and proven reserves of critical minerals that can help meet global demand.

Canada has the potential to create tens of thousands of jobs at home and export these critical minerals necessary for a low-carbon transition around the world—but only if the mining sector can navigate the significant pitfalls along the way.

Unlocking the potential

Critical transition mineral mining cannot happen without real partnership with Indigenous Peoples.

Critical transition mineral reserves are predominantly found near remote and Indigenous communities and although successful partnerships have been established between Indigenous Peoples, mining companies, and governments in recent years, the historical record is bleak. Mining companies have often entirely excluded Indigenous Peoples from consultation and participation in projects on their traditional territories while polluting their lands and irreparably harming their cultures—all with the implicit consent of government. Today, mining remains a carbon-intensive industry with a significant environmental impact that needs to be mitigated.

Beyond the need for reconciliation to atone for harms done in the past, existing governance regimes are still inadequate and need to be updated to be consistent with the United Nations Declaration on the Rights of Indigenous Peoples (UNDRIP).

Mining companies must also ensure compliance with UNDRIP and uphold the principle of free, prior, and informed consent—not only because it’s a moral and now legal imperative, but also because it’s important for their bottom line. Increasingly, investors are turning away from companies that skirt their responsibility to properly engage with Indigenous communities, while legal action brought by Indigenous groups could delay or even prevent mines from operating.

There are, however, promising initiatives that model a better approach. Impact benefit agreements such as those with the Cree Nation of Wemindji and First Nations in Northern Saskatchewan have fostered investment in local communities, job training for Indigenous residents, and continuous Indigenous involvement throughout an entire project’s life cycle. Future critical mineral mining projects could develop deeper partnerships with Indigenous communities through, for example, including equity stakes and having Indigenous leaders at the decision-making table to shape projects from start to finish.

Addressing the private finance gap

Mobilizing private finance for critical transition mineral mining and exploration will also be essential for the industry to succeed.

Canada remains one of the world’s leading hubs for mining finance, with the Toronto Stock Exchange (TSX) and TSX Venture Exchange acting as the primary listing venues for mining and mineral exploration companies globally.

However, mining projects located in Canada are often beset by regulatory challenges and expensive delays, high upfront capital costs for Northern and remote projects, and insufficient infrastructure, which make financing challenging. For instance, a proposed zinc mine in Dehcho First Nation has been delayed because of challenges in approving and constructing a winter road. Similarly, Taseko’s Gibraltar copper mine in British Columbia has been delayed because of insufficient road infrastructure which ultimately resulted in layoffs.

Raising capital specifically for transition-consistent mining operations is particularly challenging. For example, Canada is behind in establishing mandatory climate-related finance disclosure rules and in creating a stringent transition taxonomy. A robust and internationally credible investment framework could help leverage the environmental and social advantages to investing in Canada. Integrating clear metrics on Indigenous partnerships and reconciliation into these frameworks is also critical and gaining traction.

Building an industry for the future

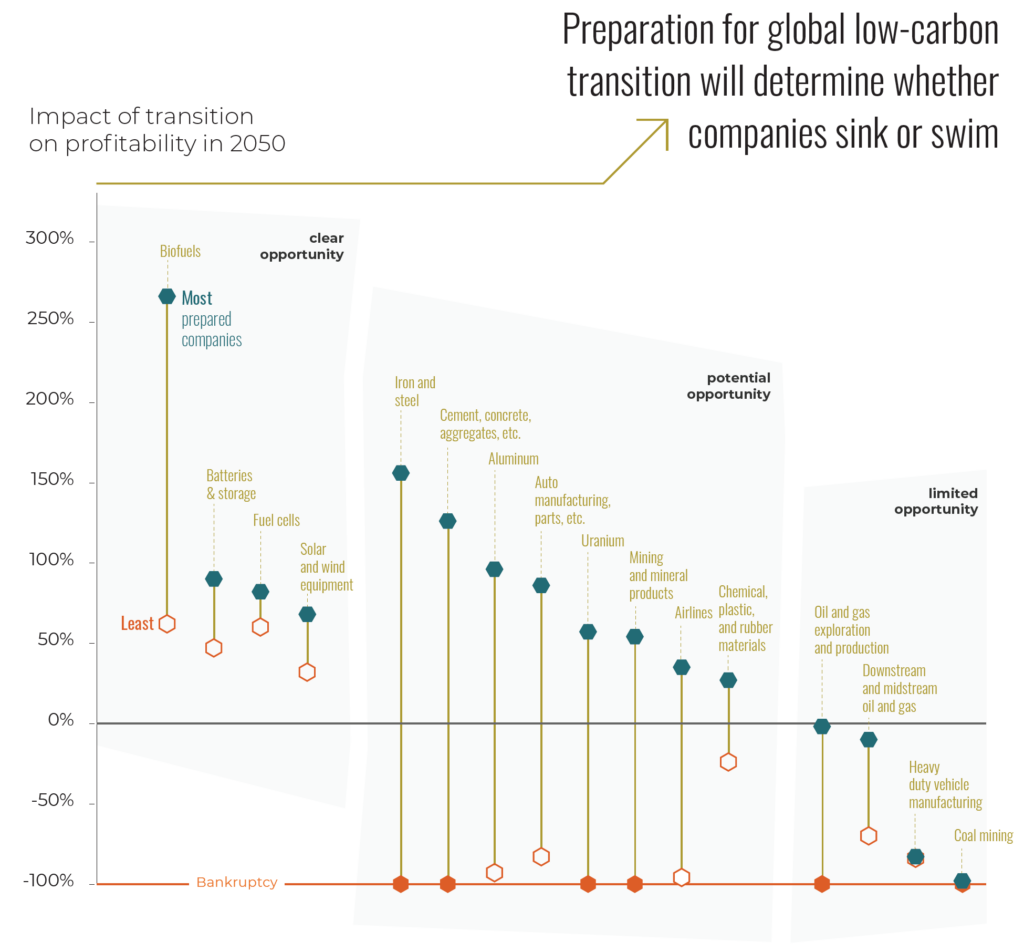

A rapid expansion in critical transition mineral mining could offset anticipated declines in other sectors as the net zero transition accelerates, creating good jobs currently provided by high-emitting sectors.

Critical mineral mining and the industries they support are poised to grow substantially in Canada and abroad. Modelling for our Sink or Swim report found that green mineral firms in Canada will see an average increase in profitability in a 1.5 degree-consistent transition of 12 per cent by 2030 (relative to a business-as-usual baseline), with the best performing firms seeing an increase of 151 per cent. The World Bank projects that global demand for minerals used for low-carbon technologies could increase by up to 500 per cent by 2050.

With demand rapidly rising, the Mining Industry Human Resources Council predicts that it will have to hire up to 80,000 new workers by 2030. Wages in mining vastly exceed other industries and the tight labour market will continue to drive up pay—making it a lucrative career choice, and one to which workers transitioning from the oil and gas sector may be well suited.

Setting the gold standard

Provincial and federal governments are increasingly recognizing the growing opportunity in critical minerals. The 2022 federal budget, for example, included $3.8 billion to implement its critical minerals strategy, including funding for key infrastructure, exploration and development, and tax credits. These efforts would build on existing and planned strategies at the provincial and territorial level.

However, turning Canada’s vast mineral reserves into a productive engine of prosperity that can supply the net zero transition will require a concerted effort by all levels of government to overcome the many barriers in the way.

Creating a gold standard for Environmental, Social, Governance, and Indigenous (ESGI) disclosure and metrics would be a good start. It ties together the need for a more inclusive and responsible approach to mining investment and, in doing so, could help attract capital and mobilize investment . Ultimately, as demand for critical transition minerals rises and supply remains volatile, Canada could emerge as a global leader—but only if it gets Indigenous partnerships and private financing right.