Improving flood risk transparency practices can drive equitable outcomes across Canada.

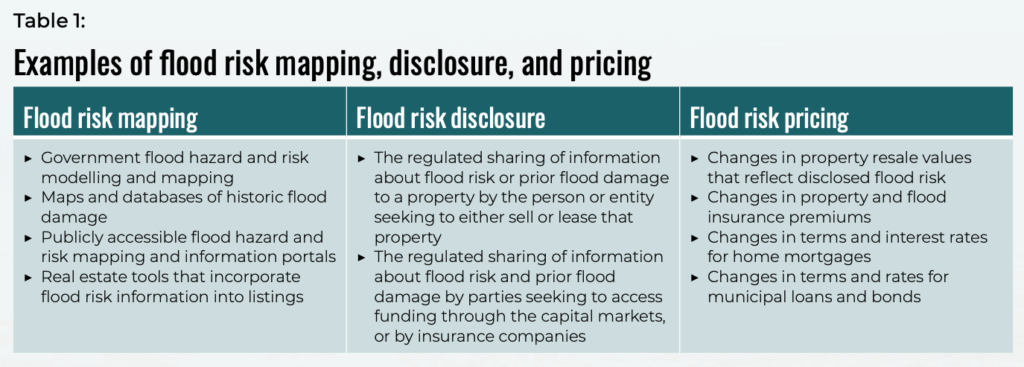

As climate change continues to increase the risk of floods, communities need support to build resilience to flooding. Improved flood risk transparency, which entails the mapping, disclosure, and pricing of flood risk, has a crucial role to play in Canada’s efforts to protect people and communities from flood risks. It can help individuals and communities decide how best to avoid, mitigate, or absorb damages and losses due to flooding.

However, in many instances, flood risk transparency practices can have disproportionately negative impacts, especially on equity-deserving groups. These groups are more likely to live in flood prone areas and are less able to access flood risk information. Equity-deserving groups are also more likely to be disadvantaged by costs related to flood risk and are often unable to afford housing in less risky areas.

What can governments do to help ease the disproportionate and inequitable impacts of flood risk transparency on equity-deserving people?

Flood risk mapping

Flood risk maps are a critical tool for understanding and mitigating flood risk. They provide valuable data on current and future flood risks for a certain area which can then inform purchasing, investment, and adaptation decisions.

But flood risk maps are not widely available, particularly in areas where equity-deserving groups are overrepresented. When they do exist, they may be 25 years or more out of date, physically hard to access, or difficult to read for audiences without technical skills.

In 2020, the federal government announced it would begin updating available maps, and committed to updating flood maps nationwide in the National Adaptation Action Plan, under the Flood Hazard Identification and Mapping Program. That is a good step, but there is no indication that the updated maps will reflect the influence of climate change.

Inaccurate or unavailable flood risk maps are an issue for any community. Those where equity-deserving groups are disproportionately represented can face a more difficult path to recovery if they are impacted by flooding. Individuals in these communities are generally less able to rely on savings to smooth over the impacts and tend to lose a greater share of their overall wealth.

To effectively build equity considerations into mapping, we need public engagement processes, including engagement with stakeholders and right holders to understand the local context and disproportionate impacts.

Flood risk disclosure

For flood mapping to support risk mitigation, property information must be disclosed in a timely, complete and accessible way.

The main mechanism for flood risk disclosure during real-estate transactions is the Property Disclosure Statement (or equivalent). It is a means for communicating to the buyer any risks related to the property. But the details of what needs to be communicated to buyers varies across jurisdictions. Inconsistencies can result in the inability for buyers to make educated decisions about the risks, including the flood risk.

Landlords in Canada are not currently required to disclose hazard or risk information about their properties during rental transactions. Renting a basement suite or in a neighbourhood with inadequate stormwater and wastewater infrastructure may be particularly risky given the higher likelihood of flooding. This significantly impacts equity-deserving communities, who are disproportionately represented among renters.

To date, property and tenant insurance transactions have yet to be used effectively to alert prospective buyers and renters about the flood risks associated with properties they plan to purchase or rent, with more severe impacts for equity-deserving communities who disproportionately live in flood-prone areas. As the flood insurance market grows, insurance agents should be required to inform their clients about the flood hazard and risk profiles of their properties. Local agencies responsible for flood management could also be supplied with flood models used by the insurance industry to underwrite flood coverage and become more active in informing residents of the potential impacts of flood hazards on their property and insurance.

Flood risk pricing

Flood risk pricing can affect real estate, insurance, and rental costs, all of which can disproportionately impact members of equity-deserving groups located.

Insurers’ understanding of risk and competitive pricing shapes the cost of property insurance. As insurers better understand flood-related risks under worsening climate impacts, the cost of insurance is rising. Across Canada, home insurance premiums increased by 20 to 25 per cent between 2015-2019. More than half of this increase is attributable to flood damage. Absent government intervention, insurance coverage may become unaffordable for members of equity-deserving groups living in flood-prone areas.

For those who already own properties, flood risk disclosure can trigger changes in property values. Catastrophic floods can significantly drop the price of real estate and reduced home values can impact savings and retirement options.

Flood risk pricing can also increase the cost of renting, as landlords pass the increased insurance cost to tenants. This disproportionately affects equity-deserving groups who are more likely to rent than others. Renters could be forced to either relocate away from their current communities or pay substantially higher rents. By reducing the relative cost of housing in flood-prone areas and increasing the cost in less flood-prone areas, flood risk pricing may lead to a cycle that disproportionately traps equity-deserving groups in higher-risk neighbourhoods.

A transformational flood risk transparency approach

The federal government, as well as many provincial, territorial, and Indigenous governments, are investing in flood mapping programs, but major gaps remain.To address these gaps, programs and strategies should engage equity-deserving groups and reflect social vulnerability. A short-term step could be to create knowledge-sharing committees that would incorporate diverse perspectives in mapping initiatives. In the longer term, governments should move towards co-development of flood mapping programs. Meaningfully including members of equity-deserving groups in the design and implementation of flood mapping programs can help ensure that the values, concerns, and priorities reflect the diversity of the communities they map.

Flood risk maps should also be designed to be accessible to the public, including equity-deserving groups. This includes making sure that the data is easy to understand so people can make informed decisions on how to prepare for and be more resilient to the impacts of flooding.

Finally, strengthening and standardizing flood-related real estate and rental disclosure requirements and guidelines could help address some of the disproportionate impacts of flood-related risks on equity-deserving communities.

Building resilience to flood risk

Building resilience to flood risk is an important step in protecting people in Canada from some of the increasingly severe impacts of climate change. A step in the right direction is better flood risk transparency so people and communities can make more informed decisions.

Read more about how policy responses can address some of the equity-related challenges related to flood risk transparency.