The Canadian Climate Institute recently published a scoping paper called Fuelling the Transition that explores whether—and under what conditions—oil and gas projects should qualify for a “transition” label under a Canadian climate investment taxonomy. It’s a complex topic, but it asks a deeply important question: how can capital markets have confidence that investments to clean up the production of oil and gas in Canada are credibly aligned with global efforts to keep dangerous temperature increases below 1.5C and assure that these investments don’t end up simply delaying Canada’s clean energy transition?

The case for including oil and gas within a Canadian Climate Investment Taxonomy

If the oil and gas sector is going to reduce its upstream emissions—which it must if the world is to protect the next generation from catastrophic climate change—it will need to invest capital on an unprecedented pace and scale. Yet there’s a significant risk that additional investments in this sector could extend or lock in future emissions and compromise Canada’s chance of hitting its national and international climate commitments.

With greenwashing in capital markets already receiving increased regulatory scrutiny in Canada, investors want greater certainty that investments that claim to decarbonize heavy industries like oil and gas actually align with credible, science-based pathways to net zero.

In 2023, Canada committed to develop a climate investment taxonomy, but what comes next—and when—is unclear.

Providing this certainty is the primary purpose of the green and transition investment taxonomy that Canada is currently developing, and Fuelling the Transition digs into the specifics to propose criteria and principles to shape how Canada’s taxonomy should assess oil and gas projects.

The standard that we propose walks a fine line. A taxonomy isn’t worth the paper it’s written on unless it has credibility. If transition-aligned is defined too loosely, it will rightly be dismissed as greenwashing. At the same time, however, the oil and gas sector is responsible for nearly a third of Canada’s total emissions; whereas most sectors are getting cleaner, oil and gas emissions remain stubbornly high. There’s a clear need to clean up the sector’s climate pollution quickly, and a taxonomy could help projects that significantly reduce that pollution attract more private finance.

Weighing a range of perspectives

This paper was intended as a conversation starter, and so far it has delivered. Early drafts sparked rich discussions with more than 40 people and organizations, along with regular input from an external oil and gas climate policy working group established by the Canadian Climate Institute.

The feedback we received ran the gamut. For some, the bar set by our proposed framework is too high. For others, the mere idea of considering oil and gas investments in any type of transition taxonomy is a non-starter. But a broad swath of people we spoke with recognize that Canada needs to swiftly ramp up private investment to decarbonize oil and gas production, with the massive caveat that these investments must proceed carefully and in a way that is aligned with global targets to limit global overheating.

Having spent the last year working on this paper, I’m confident that this balance can be struck. At its core, Canada’s proposed taxonomy is about standardizing and communicating both transition risk and transition opportunity for financial markets as the clean energy transition accelerates. Given the need to decarbonize existing oil and gas production on this pathway, including the oil and gas sector as a potential recipient of transition-aligned funding makes sense as long as it’s done cautiously, credibly, and backed by an independent process.

What we learned

Here are a few of the big takeaways from researching and writing this piece.

1. The taxonomy’s transition label can and should help facilitate pollution-reducing projects within the oil and gas sector

In Canada, upstream oil and gas emissions represent more than one-quarter of national emissions. Globally, this number is around 15 per cent. Given that the full transition away from fossil fuels could take a couple of decades, even in the most optimistic climate scenarios, there’s a clear need to make sharp reductions in the sector’s emissions, and quickly. At the same time, demand for petrochemicals and other non-combustion uses of fossil fuels could see continued growth in the energy transition. Decarbonizing oil and gas production would help reduce the lifecycle emissions for things like fertilizers, plastics, and pharmaceuticals.

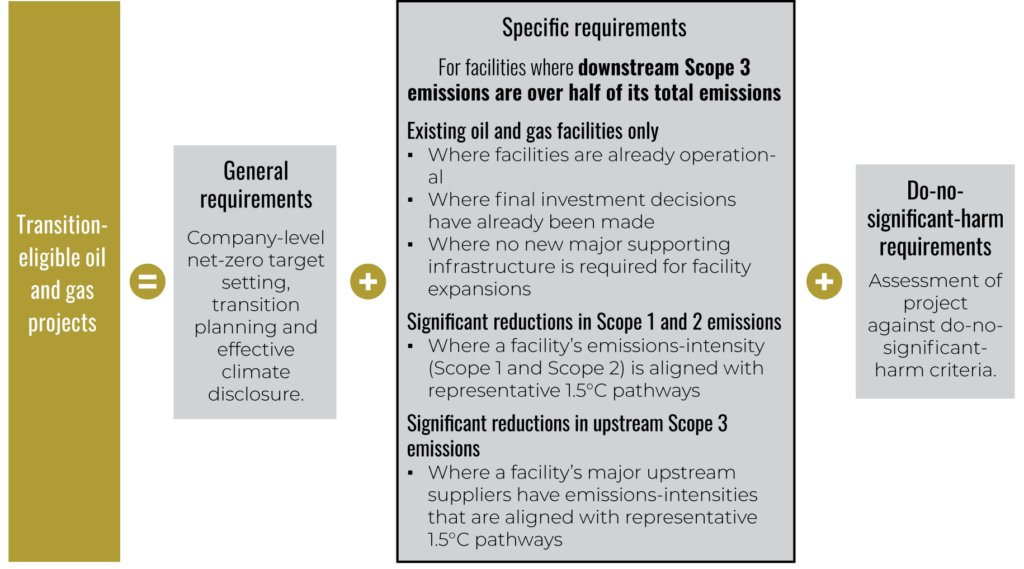

To get the taxonomy’s transition label, an oil and gas project would have to result in transformational emissions reductions. Specifically, the facility as a whole would need to significantly reduce its Scope 1 and 2 emissions over time, to a level that is consistent with 1.5°C pathways. These are the emissions that oil and gas facilities have direct control over — (the emissions these facilities don’t have direct control over, known as Scope 3 emissions, matter as well, as we’ll see).

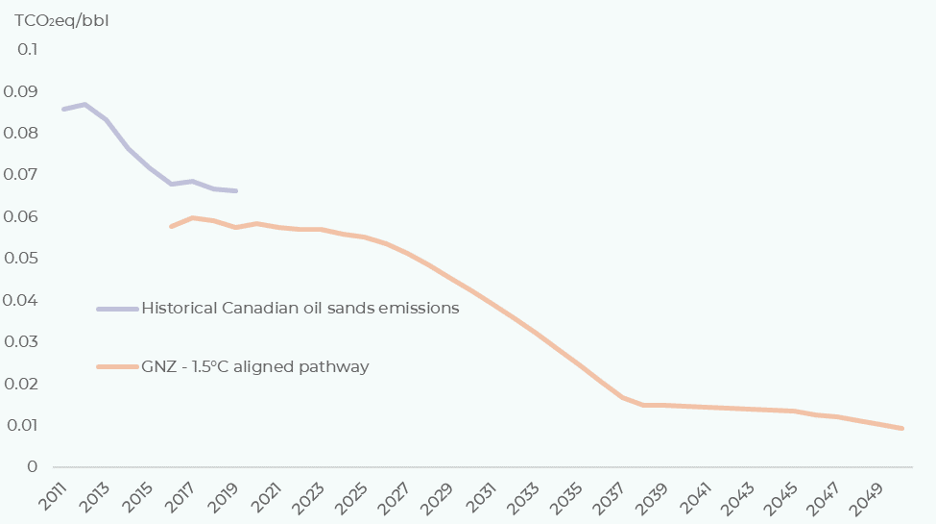

While setting the precise benchmark is beyond the paper’s scope, the figure below shows what it could look like using data from the Canada Energy Regulator’s global net zero scenario. It charts the historical emissions intensity of Canadian oil sands production alongside a trajectory consistent with a 1.5°C pathway. A project would, in other words, need to demonstrate that it can stay at, or below, the benchmark over time.

2. These decarbonization projects also need to show capital markets how they guard against carbon lock-in and manage demand-side risk

Just as industry must decarbonize its emissions, it must also reckon with its biggest vulnerability: declining global demand. Under the proposed taxonomy framework, oil and gas companies would need to have credible emissions reduction targets that align with net zero by mid-century and account for all of the emissions that occur both upstream and downstream from the oil and gas facility’s operations (Scope 3 emissions). They would also need to have credible transition plans and comply with the emerging best practices in climate-related disclosures (an area where oil and gas companies have led other sectors).

The figure below shows our proposed framework in a nutshell, including both the general requirements at the corporate level, and the requirements at the project level that determine whether a specific project meets the transition label.

3. Funds can only be spent on emissions-reducing projects if the investment is to be considered eligible for the taxonomy’s “transition” label

An important feature of our proposed framework is that the transition label would only be available for emission-reducing projects within facilities. In other words, if an oil and gas company issues a transition bond, it can’t use the proceeds for day-to-day expenditures or what is known as “sustaining capital.” Any transition loan or bond issued under the taxonomy would need to be ring-fenced for specific decarbonization investments, such as direct air capture, electrification, carbon capture, or methane leak and detection. To help ensure proper follow-through, the taxonomy would leverage international best practices for issuing sustainability bonds through the International Capital Markets Association.

4. Our framework adds much-needed sophistication in how Scope 3 emissions are treated and communicated

The bucket of Scope 3 emissions is unhelpfully large. It includes emissions from upstream suppliers, emissions from employee travel, tailpipe emissions, and also the indirect emissions from financial investments. In total, there are 15 categories of Scope 3 emissions. In writing this paper, I was shocked that no one seems to have a sophisticated way of differentiating transition risk across these 15 categories. Yet it’s clear thatdifferent types of Scope 3 emissions come with different levels and types of transition risks, and that these nuances should be reflected in a taxonomy framework.

The most important category for the taxonomy are Category 11 Scope 3 emissions. This covers emissions associated with the burning of fossil fuel products downstream from the oil and gas facility itself, and is by far the largest and most material category for the oil and gas industry. And while there’s broad agreement that industry doesn’t have agency over these emissions, it’s exactly this lack of agency that makes Category 11 emissions for oil and gas companies so different from all other types of Scope 3 emissions. The oil and gas sector—particularly upstream—cannot control consumer preferences as people and businesses increasingly shift to electric vehicles, heat pumps, and other zero-emitting technologies. This is why downstream Scope 3 emissions weigh so heavily in our proposed framework.

5. The proposed framework also adds greater sophistication in how Canada distinguishes “new” oil and gas facilities from “existing” ones, and go beyond international terminology

Organizations like the International Energy Agency and the Net Zero Asset Owner Alliance make it clear that investments in new oil and gas fields are incompatible with the pathway to net zero. For Canada, however, limiting investments only to “existing” oil fields does not provide any type of binding constraint on production. In other words, even with no new oil and gas developments in Canada, continued investments in existing fields could result in emissions well beyond Canada’s 2030 and 2050 targets.

Most oil and gas fields in Alberta, for example, have had some type of activity on them over the past 100 years, which means that major expansions and new, greenfield facilities could meet the criteria for “existing” according to the definition used internationally. The same challenge applies to the Monteney gas fields in British Columbia and Alberta, which have the potential to produce for another 60 or so years at current (record) production levels.

What does this mean in practice for the taxonomy? It means that major expansions of existing oil sands operations or conventional oil and gas fields would likely be defined as “new” under the proposed framework and therefore ineligible for taxonomy financing—even if all the other requirements are met.

6. Midstream and downstream oil and gas facilities are also eligible for a “transition” label in our proposed framework, and may actually have more opportunities to diversify and decarbonize

Midstream oil and gas facilities include processing, storing, and transporting of fuels, while downstream facilities include refineries. We include these types of activities within our framework for the same reasons that we include upstream activities: reducing climate pollution from midstream and downstream facilities is a critical challenge in the transition that requires both significant private investment as well as firm guardrails against locking in more carbon emissions.

In its treatment of midstream and downstream facilities, the framework recognizes that any new facilities could have significant implications on emissions further upstream, as well as for emissions from when consumers ultimately use (burn) the fuels. In particular, building new midstream facilities can induce demand for continued or expanded oil and gas production further upstream, which is necessary to supply the midstream facility. For example, Phase 2 of the LNG Canada project is expected to induce demand for drilling additional gas wells to provide gas that the project will liquify and transport. Because that project is predicated on such increases in production it would likely not meet our framework’s definition of “existing” oil and gas.

However, it’s also true that midstream and downstream companies have more opportunities to diversify their businesses as demand for fossil fuels declines, so are less at risk of becoming stranded assets. Some fuels retailers, such as Parkland and Petro Canada, for example, are starting to integrate electric charging stations within their business model. Sustainable biofuels, electrification, and pipelines that can be future-fitted to move clean fuels like hydrogen in the future are all examples of how midstream and downstream companies can shift into markets that are expected to grow in the energy transition, and could therefore become eligible for the taxonomy’s transition label.

7. Without a made-in-Canada taxonomy framework, investors could default to using other international frameworks that don’t always align with this country’s economic and climate objectives

An effective and credible taxonomy is critical to Canada navigating (and funding) its clean energy transition at the speed and scale required. Canada has a unique opportunity to become a leader with its Climate Investment Taxonomy and provide a sophisticated definition of what qualifies as a “transition” investment in the energy transition. Few jurisdictions have made progress in this space, and clear guidance on the transition label could position Canada’s economy to be increasingly competitive in a low-carbon world.

To seize this opportunity, however, Canada needs to create an independent, inclusive, and established body to build and maintain a national taxonomy. The taxonomy roadmap released by the Sustainable Finance Action Council in March 2023 provides an excellent foundation, and the Canadian Climate Institute’s Fuelling the Transition paper clarifies how the roadmap could be applied to a single sector. Future research can propose similar standards for other important sectors that need to decarbonize in the transition, such as Canada’s mining sector.

Ultimately, however, if markets are going to implement and use the taxonomy to guide investment decisions, regulatory oversight bodies in Canada must formally adopt it as a standardized framework. The Government of Canada committed $1.5 million in the 2023 Fall Economic Statement toward developing the taxonomy, but what comes next, and when, is unclear.

Taxonomies being developed in other jurisdictions, such as the European Union and Australia, are starting to shape best practices for international capital markets. There’s a real risk that if Canada doesn’t act quickly to develop its own taxonomy, it will have to accept the framework of others, which may not align with the country’s climate and economic goals.

Parting thoughts

Taken as a package, the proposed criteria and thresholds outlined in Fuelling the Transition provide a credible path for determining which pollution-reducing projects in the oil and gas sector could qualify for the taxonomy’s transition label and therefore be eligible for preferential lending terms.

Canada needs a taxonomy that can help drive transformational investments to decarbonize the oil and gas sector, while guarding against locking in emissions from new fossil fuel projects. Striking this balance will not be easy, but this paper lays out a sound and credible path that can help Canada both meet its climate goals and keep the country competitive in a low-carbon world.